Philip Sidney, Senior Associate, Lintstock Ltd, provides a concise overview of the firm’s latest research report on board oversight in challenging times, published in November 2023, and highlights the six key governance themes that emerged from the study.

Highlights

- over 150 directors and company secretaries in the UK participated in Lintstock’s latest research report on how the recent crises of 2020– 2022 would affect corporate governance going forward

- these crises were predominantly non-financial in nature, impacting boards in a wide range of areas, such as employee well-being, geopolitical tensions, ESG, digital transformation and supply chain distribution

- companies in the future will need to be flexible enough to move quickly when required, while also possessing sufficient financial, material and human resources to weather a period of extreme turbulence

Crises are a fact of corporate life and, as such, boards must always be prepared to respond to shocks as part of their oversight role, as well as assisting in their company’s recovery once the crisis has passed. Whatever the size of a given organisation or the geography or sector it operates in, it is inevitable that business as usual will be disrupted by an unexpected problem or incident that has material consequences, perhaps even threatening the survival of the company. In these situations, the board must oversee the company’s response and communication with investors and stakeholders, as well as ensure that lessons have been learned once the dust has settled. While certainly not the most eagerly anticipated aspect of board service, most directors embrace the challenge when called upon. Certainly, the events of recent times have tested the mettle of board members. The Covid-19 pandemic and the outbreak of war in Ukraine have made the past three years the most challenging period for corporate boards since the global financial crisis of 2007–2008.

Much in the same way as the financial crisis had an enduring impact on corporate governance, the pandemic and the Ukraine war will change how companies are run in the future – though in contrast to the financial crisis, the crises that hit in 2020–2022 were notably non-financial in nature. The response post 2008 was principally focused on financial services companies and on improving their financial risk monitoring and resilience. In contrast, the recent non-financial crises have implications for boards in a much broader range of areas, including employee well-being, geopolitical tensions, ESG, digital transformation, supply chain distribution and many more.

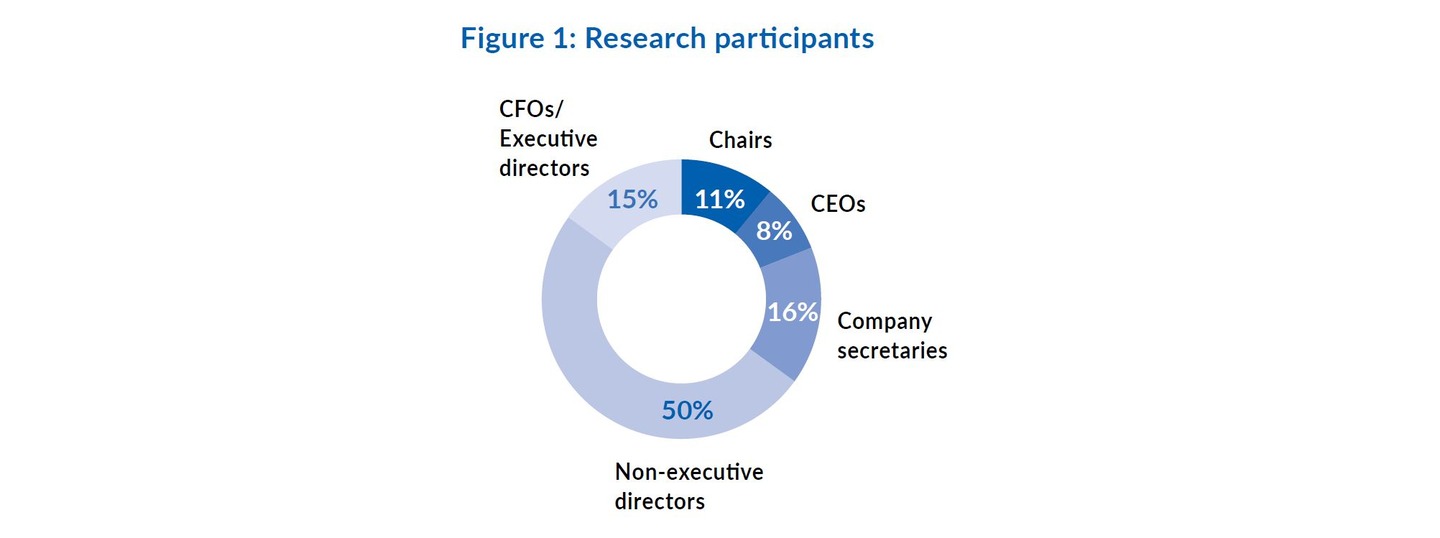

As a board evaluation firm that witnessed companies tackling the Covid and Ukraine crises in real time, we wanted to capture the learning from this period and explore director sentiment around the longer-term implications for corporate boards. Accordingly, we asked the boards of leading UK companies for their views on how the recent crises would affect corporate governance going forward. Over 150 directors and company secretaries participated (see Figure 1), and we are grateful to them for their engagement and candour.

The resulting report, Board Oversight in Difficult Times: Out of Covid into War – published in partnership with the UK All Party Parliamentary Corporate Governance Group – dives into the six key themes that emerged from our inquiry and examines the spread of opinion amongst directors on how Covid and Ukraine will affect governance at the top of organisations over the longer term, both in the UK and internationally. This article briefly outlines these themes.

Risk management and scenario planning

Covid and the invasion of Ukraine took many boards by surprise. The pandemic in particular blindsided a lot of companies, and even companies in highly relevant industries such as insurance and pharmaceuticals did not have a health crisis on their radar, let alone their risk register. In board review exercises in 2021 it was common to see directors admit that they had not seen Covid coming, but also consoling themselves that other boards had not spotted it either.

As a result, much of the commentary on risk in our research suggested that companies need to rethink their approach in this area – there was a sense that focus on the minutiae of risk registers and risk matrices had left boards unprepared to face threats at a macro level. The need to widen the lens on risk was stressed and it was felt that even seemingly impossible risks ought to be analysed more closely – respondents repeatedly emphasised the importance of expecting the unexpected and thinking the unthinkable.

That said, there was recognition that it is not possible for boards to predict the future. In the absence of a crystal ball, it is unreasonable to expect organisations to consider and prepare for every possible scenario. Instead, it was suggested that boards need to focus on what they can control – namely the systems and processes that they have in place to respond to risks. Ensuring the companies that boards oversee can maintain business continuity, safeguard the well-being of employees and communicate with and reassure key stakeholders is crucial, whatever the nature of the next crisis.

Agility and resilience

Agility and resilience were identified as hallmarks of a successful company coming out of the past few years. The events of 2020–2022 have amply demonstrated that companies can be placed under severe pressure very quickly and it is clear in the continuing atmosphere of global instability that organisations worldwide are extremely vulnerable to being overtaken by events. The past few years have provided multiple stress tests and have drawn boards’ attention to the dangers of being overlean – the emphasis is now less on ‘just in time’ and more on ‘just in case’.

Encouragingly, the lessons that many companies learned in this area were felt by participants to have come in useful when dealing with the initial shock from the war in Ukraine – boards had become used to making quick decisions under conditions of uncertainty and then implementing them at pace, and so were in a position to deal swiftly with issues around employee safety and flexing their supply chain.

There is of course a balance to be struck between being swift-footed enough to respond to crises and having sufficient resilience to withstand the initial shock, but it is clear that companies in the future will need to have the flexibility to be able to move quickly when required, while also possessing the necessary financial, material and human resources to weather a period of extreme turbulence.

Technology and AI

Technological capability has long been an important attribute of a successful company, but Covid forced an acceleration on all organisations in this area. Amid national and international lockdowns, the need to move operations online effected a digital transformation overnight. Technology is now essential, and participants in our research noted the benefits in terms of increased efficiency and the environmental positives of paperless working and reduced travel.

There was also widespread consciousness of the risks that come with the growing dependency on IT and digital, however. It was noted that – having plugged into the technological revolution – companies must continually reinvest in up-to-date systems in order to stay ahead of their rivals, while the move online also heightens exposure to cyber risk. Boards are increasingly vigilant in this area and conscious of the need to keep up – in the board reviews we conduct, the addition of greater technological or digital expertise regularly features as a key recommendation.

Artificial intelligence (AI) also attracted considerable comment among our participants and recent developments in this area have meant that this topic has risen up boards’ agendas this year, having attracted relatively little attention in board review exercises before then. Several board members identified AI as a significant risk, but there was a spread of opinion on whether the changes that this technology could make in the business paradigm present more potential upside or downside. We have spoken to a number of company secretaries who acknowledge the significant benefits of implementing AI (for example, improvements to pricing algorithms), but have serious concerns around the potential risks.

respondents repeatedly emphasised the importance of expecting the unexpected and thinking the unthinkable

ESG and climate

ESG was a major area of focus among the participants in our research, reflecting the increased degree of airtime that it has received both in boardrooms and in wider conversations around corporate practice – one Chair stated that ‘sustainability has rightly taken centre stage’. ESG is now ‘the second bottom line’ in the words of one non-executive – the success of a company is now judged by its environmental and social impact, as well as its operational and financial performance, and there is growing emphasis on stakeholder interests alongside shareholder returns.

The pandemic and the Ukraine conflict have intensified companies’ awareness of the need to focus on non-financial as well as financial performance, and to ensure that their working practices, executive remuneration, tax affairs and supply chain do not expose them to reputational risk – and consequent commercial fallout.

There was, however, a degree of resistance to the level of focus on ESG, with some participants expressing particular concern around the reporting burden that it places on businesses. There are still question marks around how ESG performance should be assessed and measured – there was controversy earlier this year over tobacco companies such as Philip Morris International scoring higher than Tesla on the S&P 500 ESG Index – and we know of more than one board that is questioning whether they may have overreached themselves in their public ESG commitments.

Redrawing the working contract

Covid brought about significant changes in working practices, which in turn have major implications for companies’ relationships with their workforce going forward. Working through the stresses of the pandemic brought many companies closer to their employees – boards demonstrated real interest in and focus on the safety and well-being of their staff, who are themselves grateful to boards for their support and concern through the crisis.

Yet if the pandemic has rewritten the contract between organisations and staff, it has also led to a change in expectations around ways of working, especially remote work. Many employees are unwilling to relinquish the benefits of working from home, but some companies are finding that this has negative implications for productivity – we know of one company who surveyed their employees and found that most felt that they were more efficient when working remotely, but then conducted an objective analysis of their output that suggested the opposite was the case.

The lack of time in the office was said to have had a particularly negative impact on young people at the beginning of their careers. Coupled with the level of competition for talent internationally – and with technological advancements making high-quality employees more mobile than ever – there is now a greater need for companies to devote serious focus to attracting, retaining and developing talent in order to ensure they have the requisite human resources for future success.

UK environment and policy

A remarkable feature of the feedback we received for our study was the pessimism around the UK business environment, as well as the level of disillusionment with the UK government and regulators. Directors expressed strong opinions around the level of regulatory and compliance burden faced by their companies and bemoaned the uncertainty and short-termism that make it impossible to plan for the longer term. One non-executive made reference to ‘thoughtless game-changing policy leaps which overnight blow up business models’.

On the face of it, this theme might be less relevant to readers of this journal as Hong Kong does not necessarily face the same challenges as the UK – among them stagnating productivity, decaying infrastructure and the fallout of Brexit. Nevertheless, it does underscore the closeness of the link between political decisions and business success, and the need for trust between corporates and government. The UK government’s handling of the pandemic, as well as the instability arising from the swift turnover of prime ministers in the last year, has engendered a lack of confidence that will impede growth.

Conclusion

Emerging from the pandemic and the initial fallout of the Ukraine conflict, companies face a complex and interconnected set of challenges that give rise to a bewildering array of risks. Alongside the traditional financial and operational considerations come geopolitical risk, climate risk, people risk and supply chain risk, among many others, with the ever-present threat of reputational consequences if they fail to succeed in any of these areas.

In many ways the fundamental task for boards today is to prioritise appropriately, allocating their limited time so as to be able to address short-term challenges while giving thought to the longer-term strategic picture. The key themes highlighted above each demonstrate the need for boards to balance the demands of the moment with the future success of their organisations.

Philip Sidney, Senior Associate

Lintstock Ltd

The author can be contacted via email: ps@lintstock.com. To read Lintstock’s Board Oversight in Difficult Times: Out of Covid into War in full, please visit http://www.lintstock.com/boardoversight.

Lintstock is a London-based corporate governance advisory firm specialising in board effectiveness reviews. The firm conducts leading-edge research into governance issues, and hosts webinars and workshops for company secretaries around the world.