Authors at the Research Centre for Sustainable Hong Kong, City University of Hong Kong, make some policy suggestions to help Hong Kong achieve its greenhouse gas emissions reduction targets.

Highlights

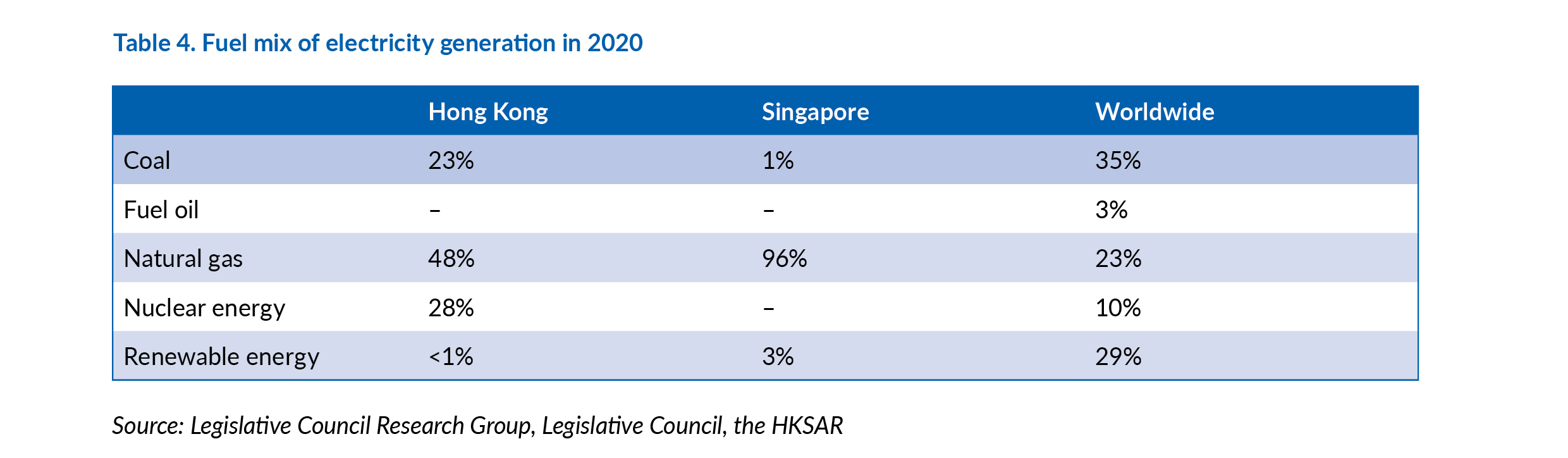

- 23% of Hong Kong’s fuel for electricity came from coal in 2020, as compared to 1% in Singapore

- to achieve its 2050 carbon neutrality goal, Hong Kong needs to increase the renewable fuel mix for electricity generation

- Hong Kong has yet to implement a carbon tax in contrast to Singapore, which started imposing such a tax in 2019

This article compares the emissions reduction policies in Singapore and Hong Kong, outlines the different areas of emphasis in the two cities’ respective strategies and recommends some directions to enhance the effectiveness of Hong Kong’s emissions reduction policies.

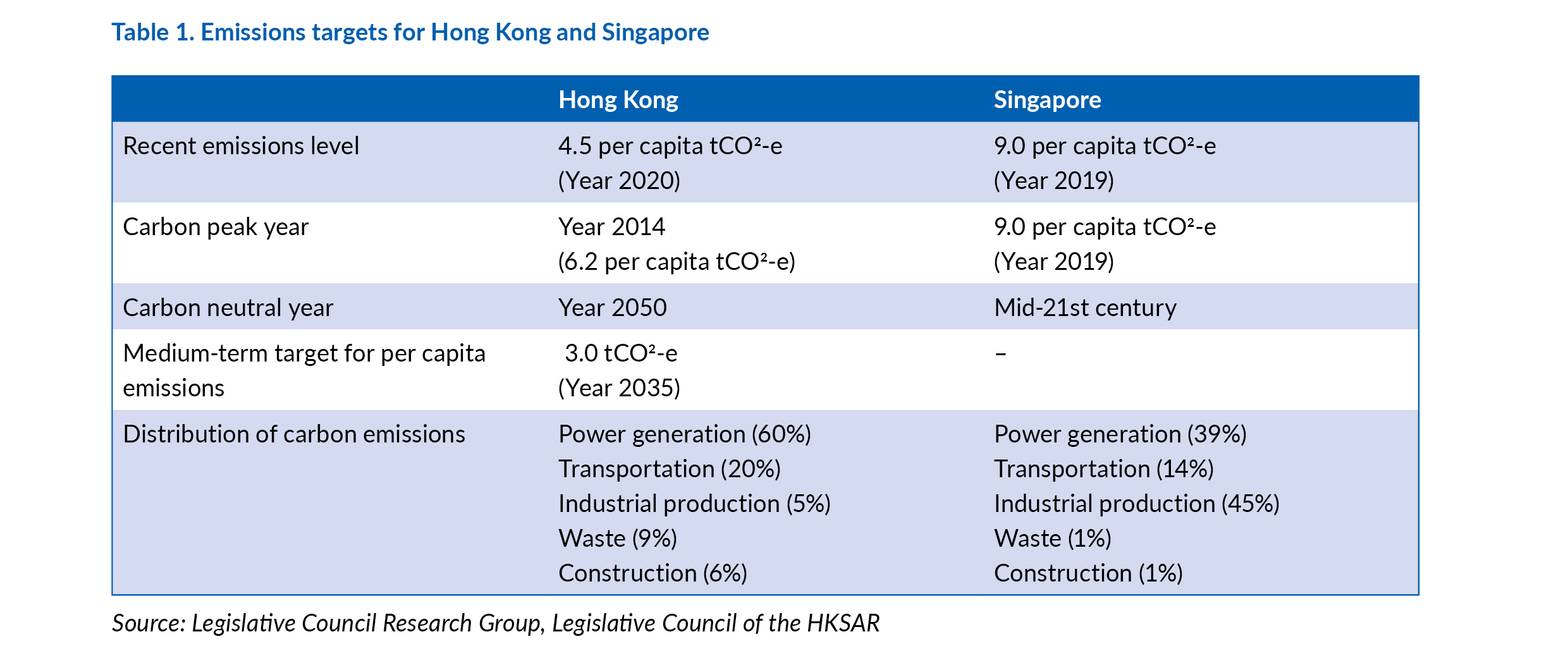

Hong Kong’s annual per capita greenhouse gas (GHG) emissions in 2020 was 4.5 tCO2-e (this represents the amount of GHG emissions measured in metric tons of carbon dioxide equivalent). This is lower than Singapore’s by more than 50%. However, if Hong Kong is to achieve the government’s medium-term target of reducing Hong Kong’s emissions by 50% before 2035, as compared to the 2014 level, current emissions reduction policies will need to be reviewed.

The Hong Kong Government published its Hong Kong Climate Action Blueprint 2050 in 2021, outlining four major strategies and measures to reduce carbon emissions, namely:

- net-zero electricity generation

- energy-saving and green buildings

- green transport, and

- waste reduction.

Compared with Singapore, Hong Kong has performed well in reducing GHG emissions and it is being more aggressive in achieving carbon neutrality. Due to its different economic structure, Singapore’s high energy-consuming secondary (manufacturing) industry accounts for nearly 30% of its GDP and produces far more emissions than the tertiary (services) industry of Hong Kong, which accounts for 94% of Hong Kong’s total economic output.

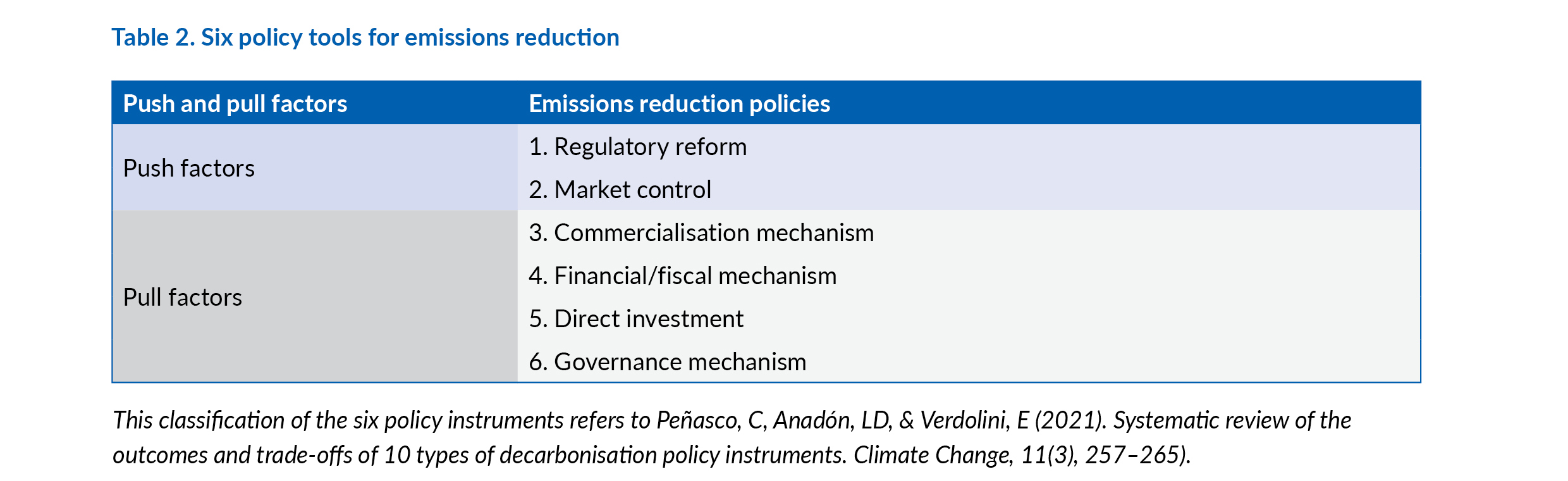

However, if Hong Kong intends to achieve its medium-term emissions target it will need to further reduce carbon emissions by one-third as compared to the 2020 level (see Table 1). Formulating effective emissions reduction policies requires the use of ‘push’ and ‘pull’ factor policies. Push factor policies aim to encourage society to abandon the use of high-emissions technology and energy by increasing the cost of such technology and energy. By contrast, pull factor policies focus on enticing society to use more low-carbon technology and energy by reducing the cost of such technology and energy.

Six emissions reduction policy tools

Based on the push and pull factors described above, we have deduced six emissions reduction policy tools (see Table 2). ‘Regulatory reform’ and ‘Market control’ measures adopt the pricing method of the social cost of carbon emissions. They price in the emissions fee and increase the total cost for high-emissions technology and energy.

“in terms of using renewable fuel for electricity generation, Hong Kong lags significantly behind Singapore and the world”

- Regulatory reform – focuses on the influence from the government, such as raising the price of fossil fuels through administrative means.

- Market control – focuses on establishing trading mechanisms, such as establishing carbon emissions trading systems and imposing carbon taxes to induce compliance from the market.

- Commercialisation mechanism – promotes the use of brand new low-carbon technologies through commercial means and market mechanisms, such as providing financial guarantees for investors.

- Financial/fiscal mechanism – refers to policies that ensure higher profits or lower operating costs in low-carbon technologies for investors, such as direct or indirect subsidies (for example feed-in tariffs) or loans with below-market interest rates.

- Direct investment – refers to government funding to specific projects or companies to support the development of low/net-carbon energy technologies.

- Governance mechanism – refers to guidelines that evaluate the operations of a company (for example ESG standards) and help investors to identify whether the company can achieve the carbon reduction targets.

Comparison of the emissions reduction policies of Hong Kong and Singapore

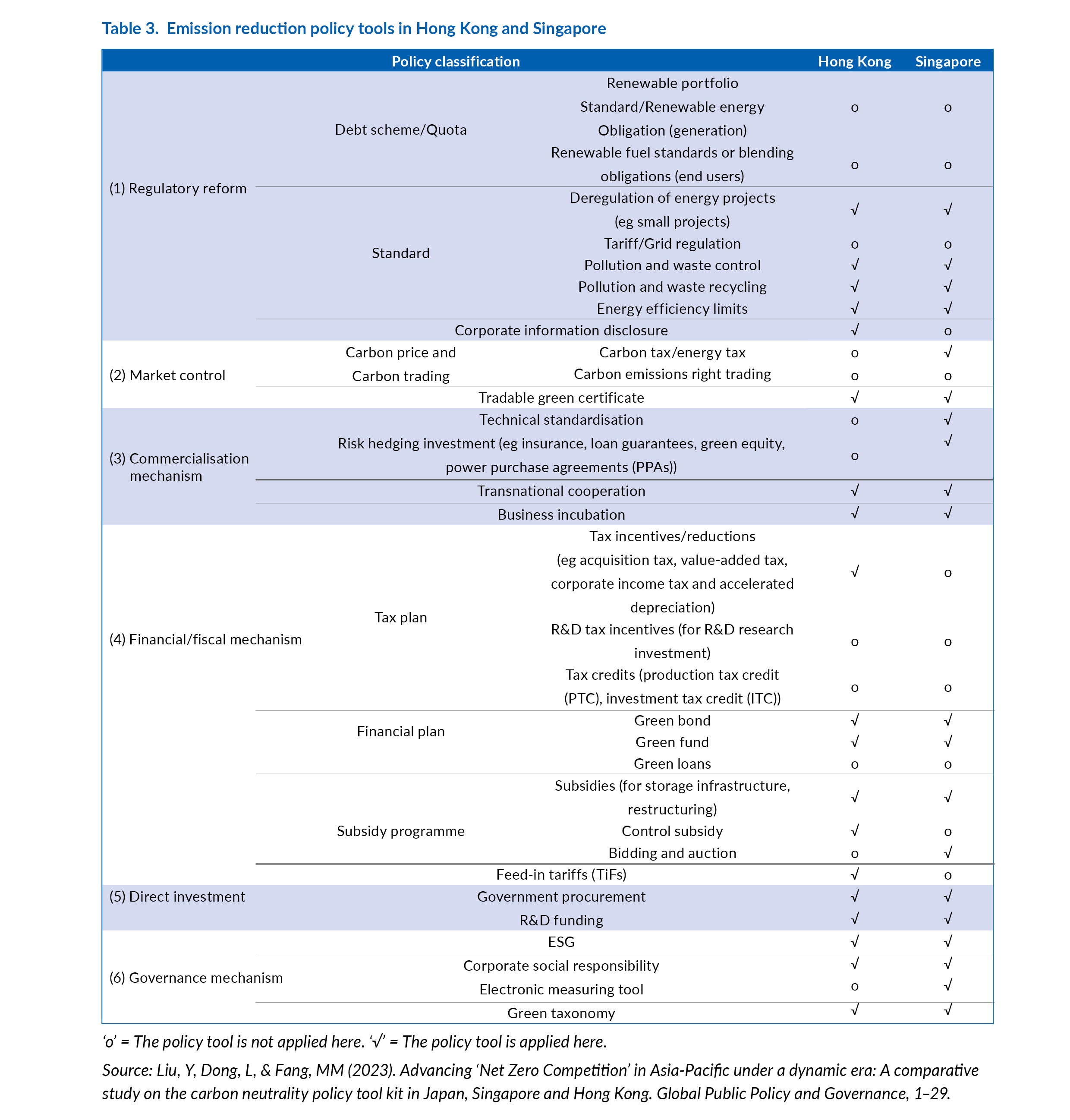

We further break down the six policy tool kits into 31 sub-items, and highlight the differences between the emissions reduction policies adopted in Hong Kong and Singapore (see Table 3). We note several major differences discussed below.

Imposing a carbon/energy tax

A carbon/energy tax is a market control mechanism that aims to pressure companies and individuals to reduce their carbon footprints by introducing a hefty price tag on carbon emissions. A study of Japan’s long-term economic data found that a carbon tax would have a minimal impact on the country’s economy and would allow an effective allocation of tax revenue towards green energy technology subsidies, while also enabling the reduction of other taxes.

Singapore started imposing a carbon tax of US$11 (approximately HK$86) per ton of carbon dioxide in 2019.

The tax will progressively increase to the target price of US$29 (about HK$227) per ton of carbon dioxide by 2030. However, Hong Kong has yet to implement a carbon tax as the city mainly relies on imported coal and natural gas for energy production, and there are fears that imposing a carbon tax may harm the stability and cost of energy supply in Hong Kong.

Using renewable fuel for electricity generation

In terms of using renewable fuel for electricity generation, Hong Kong lags significantly behind Singapore and the world (see Table 4). 23% of Hong Kong’s fuel for electricity came from coal in 2020, as compared to 1% in Singapore. Without CLP Power Hong Kong’s purchase of 10 billion kilowatts of electricity from Daya Bay Nuclear Power Plant annually, coal would take up more than 30% of Hong Kong’s total fuel mix of electricity.

Technical standardisation and risk-hedging investment tools

Technical standardisation facilitates technical collaboration across regions and organisations. Risk-hedging investment is a risk offset strategy favoured by multinational green investments. Considering the confined territorial areas of Hong Kong and Singapore, the mutual recognition of international carbon credit certificates and cross-border circulation of carbon trading would be beneficial. Hong Kong could use financial, technical and marketing support as incentives to attract local enterprises to participate in global renewable energy projects.

Singapore is the market leader in solar photovoltaics, and the city actively promotes international cooperation and technology transfer of renewable energy projects. While Hong Kong encourages cross-border collaboration on carbon-neutral technologies, it has yet to introduce any concrete measures to back up this policy.

Summary

This paper examines the differences between the carbon reduction policies of Hong Kong and Singapore, and makes recommendations to improve Hong Kong’s emission reduction measures. There is no one-stop policy solution as each policy has its advantages and limitations, so we shall need to implement a variety of measures to achieve carbon neutrality.

Linda Chelan Li, Yunhong Liu, Liang Dong, Phyllis Lai Lan Mo, Kin On Li

Research Centre for Sustainable Hong Kong, City University of Hong Kong

This article is based on Policy Paper 21 of the Research Centre for Sustainable Hong Kong, City University of Hong Kong. It is the first of three papers making policy recommendations to help reduce GHG emissions in Hong Kong.

“while Hong Kong encourages crossborder collaboration on carbon-neutral technologies, it has yet to introduce any concrete measures to back up this policy”