Capital attraction – SFC and HKMA streamline suitability obligations for sophisticated professional investors

Richard Mazzochi, Partner, Urszula McCormack, Partner, Cross Border Finance and Technology, Cindy Shek, Partner, and Nikita Ajwani, Associate, King & Wood Mallesons, summarise a new streamlined approach for compliance with suitability obligations when dealing with sophisticated professional investors, and explain why this initiative matters.

Highlights

- the HKMA and the SFC have recently provided intermediaries with further guidance on applying a proportionate and risk-based streamlined approach when dealing with Sophisticated Professional Investors (PIs)

- the Streamlined Approach can be applied where the Sophisticated PI has met three additional qualifying tests, namely financial situation, knowledge or experience (sophistication) and investment objectives

- investment transactions that are considered eligible under the new approach must fall within the specified Product Category and Streamlining Threshold

On 28 July 2023, the Hong Kong Monetary Authority (HKMA) and the Securities and Futures Commission (SFC) issued a joint circular to intermediaries, setting out a streamlined approach for compliance with suitability obligations when dealing with sophisticated professional investors (Sophisticated PIs) who possess higher levels of net worth and knowledge or experience (the Circular).

This article summarises the key things to know about:

- why this streamlining initiative matters, and

- how the new measures work.

Why this matters – quick context

Suitability obligations have long been a feature of Hong Kong’s financial services regulation and have played a significant role in conduct and enforcement. Before the 2007/08 financial crisis, suitability was not required for all types of ‘professional investors’, as defined under Cap 571 and related rules, but this was later significantly refined to require suitability assessments for individual professional investors, plus accreditation obligations for corporate professional investors before suitability could be waived.

One of the most critical impacts of suitability is that assessments must occur whenever a recommendation or solicitation is made, which carries the consequence of a more complex pre-trade experience. This can significantly support investor protection, subject to a nuanced and risk-based approach to cater for different knowledge, experience and net worth.

To support the industry, the HKMA and the SFC updated the FAQs in December 2020 to clarify the expected standards on how the suitability assessment should be conducted, and how product information should be explained and disclosed to clients of different degrees of financial sophistication. Intermediaries were then able to tailor point-of-sale procedures to the personal circumstances of Sophisticated PIs.

The HKMA and the SFC have now provided intermediaries with further guidance on applying a proportionate and risk-based streamlined approach when dealing with Sophisticated PIs (Streamlined Approach). Detailed guidance is set out in Annex 1 to the Circular (Annex 1), with updated FAQs in Annex 2 to the Circular (Annex 2).

The Streamlined Approach supports Hong Kong’s continuing efforts to attract local and international capital – in this case, for the ultra-high net worth market segment.

Summary – what is now possible?

An intermediary may rely on information about a client as obtained during onboarding or know-your-client (KYC) reviews and ascertain if the client qualifies as a Sophisticated PI. Where an intermediary is reasonably satisfied that the Sophisticated PI exhibits the degree of sophistication and has an appropriate loss absorption ability, it may apply a Streamlined Approach to allow the Sophisticated PI to set aside an appropriate amount for investment in a portfolio of investment products with various risk return profiles (including high-risk investment products).

Under the Streamlined Approach, the intermediary is not required at a transaction level to match the Sophisticated PI’s risk tolerance level, investment objectives and investment horizon, or to assess the Sophisticated PI’s knowledge, experience and concentration risk.

This can have a significant impact on user experience, as it may allow Sophisticated PIs (except for conservative clients) to access a wider range of investment products and/or a higher proportion of high-risk investment products that may not have been previously available.

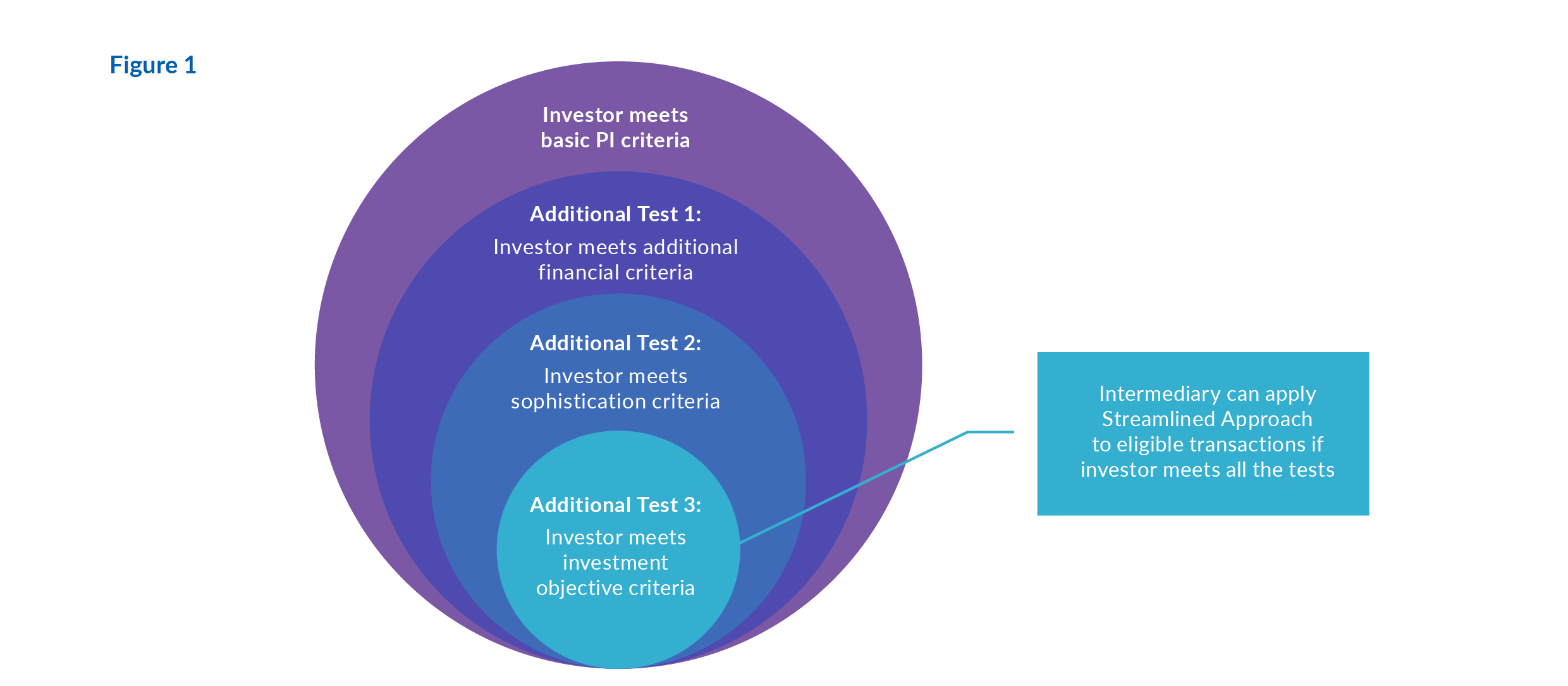

Figure 1 illustrates this simply. In short, only a small (but important) subset of professional investors are eligible.

Further detail

1. Qualifying criteria – who is eligible to be a Sophisticated PI?

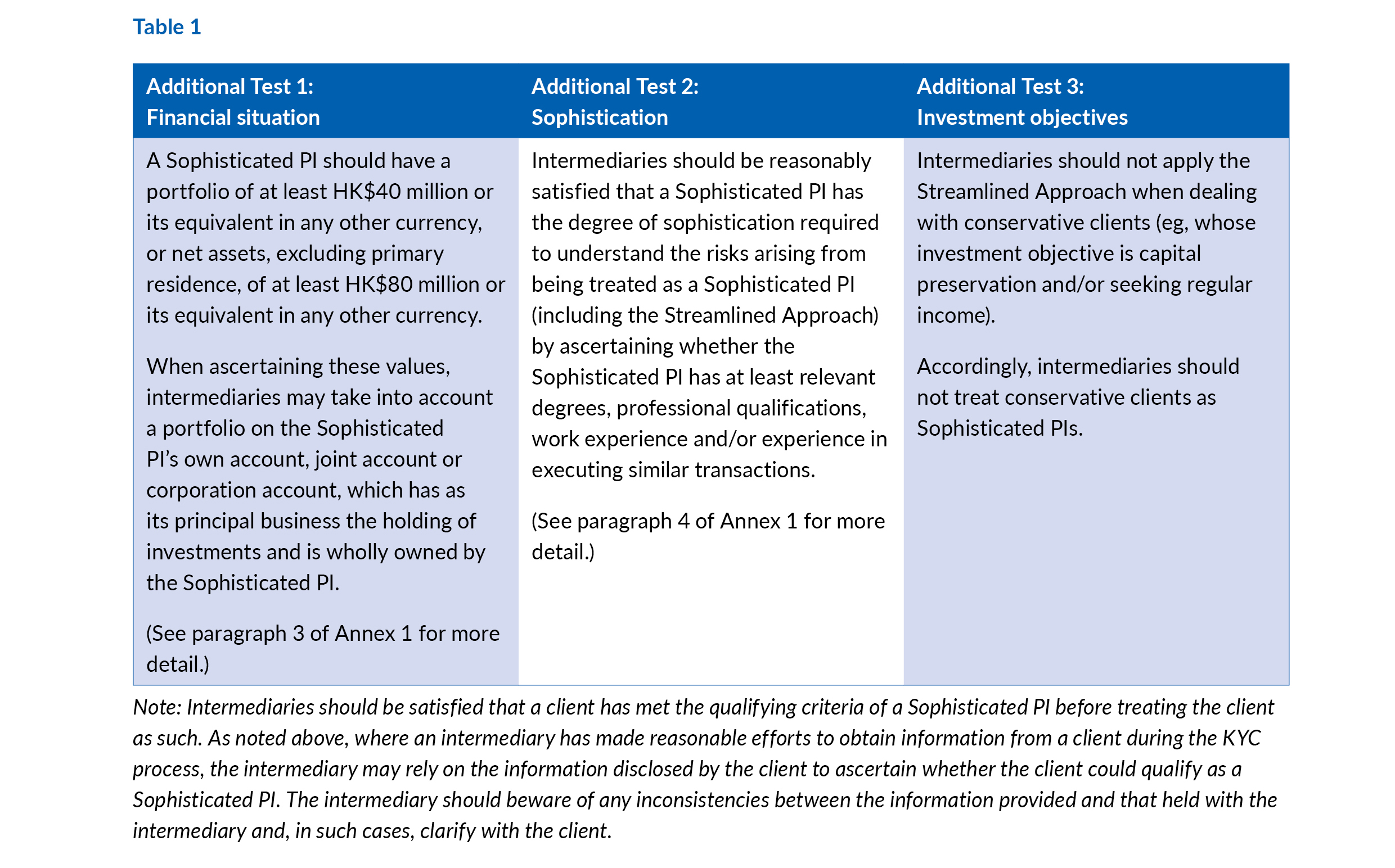

A Sophisticated PI refers to an individual professional investor who satisfies at least each of the following criteria (see Table 1).

2. Eligible Investment Transactions – which transactions can be executed under the Streamlined Approach?

Intermediaries must only execute investment transactions for a Sophisticated PI under the Streamlined Approach where the transactions fall within the Product Categories and the Streamlining Threshold (collectively, Eligible Investment Transactions).

The following summary breaks down the requirements:

Product Categories. This involves three key steps:

- Intermediaries must devise (or adjust as appropriate) Product Categories to categorise investment products based on the terms and features, characteristics, nature and extent of risks of investment product.

- The Sophisticated PI should then specify the Product Categories within which investment transactions could be executed under a Streamlined Approach.

- Intermediaries must then document the choice of the Sophisticated PI and provide a Product Category Information Statement (Product Statement) to the Sophisticated PI to explain the terms and features, characteristics, nature and extent of risks of investment products within such Product Category, including any warning statements in relation to the distribution of complex products.

(See paragraph 7 of Annex 1 for more details.)

Streamlining Threshold. The Sophisticated PI must specify a maximum threshold of investment, as an absolute amount or a percentage relative to the Sophisticated PI’s assets under management (AUM) with the intermediary, that is acceptable to be executed under a Streamlined Approach (Streamlining Threshold). The Sophisticated PI may then specify a Streamlining Threshold appropriate to their circumstances and the intermediary is required to maintain proper records of setting any such a threshold, including the Sophisticated PI’s rationale that provides support for setting such a threshold. Intermediaries are required to establish and maintain effective systems and controls to ensure compliance with the Streamlining Threshold, including to discuss the Streamlining Threshold with the Sophisticated PI at least annually.

(See paragraph 8 of Annex 1 for more details.)

3. Streamlined Approach – which intermediary procedures can be streamlined?

A number of procedures can be streamlined when dealing with Sophisticated PIs in Eligible Investment Transactions.

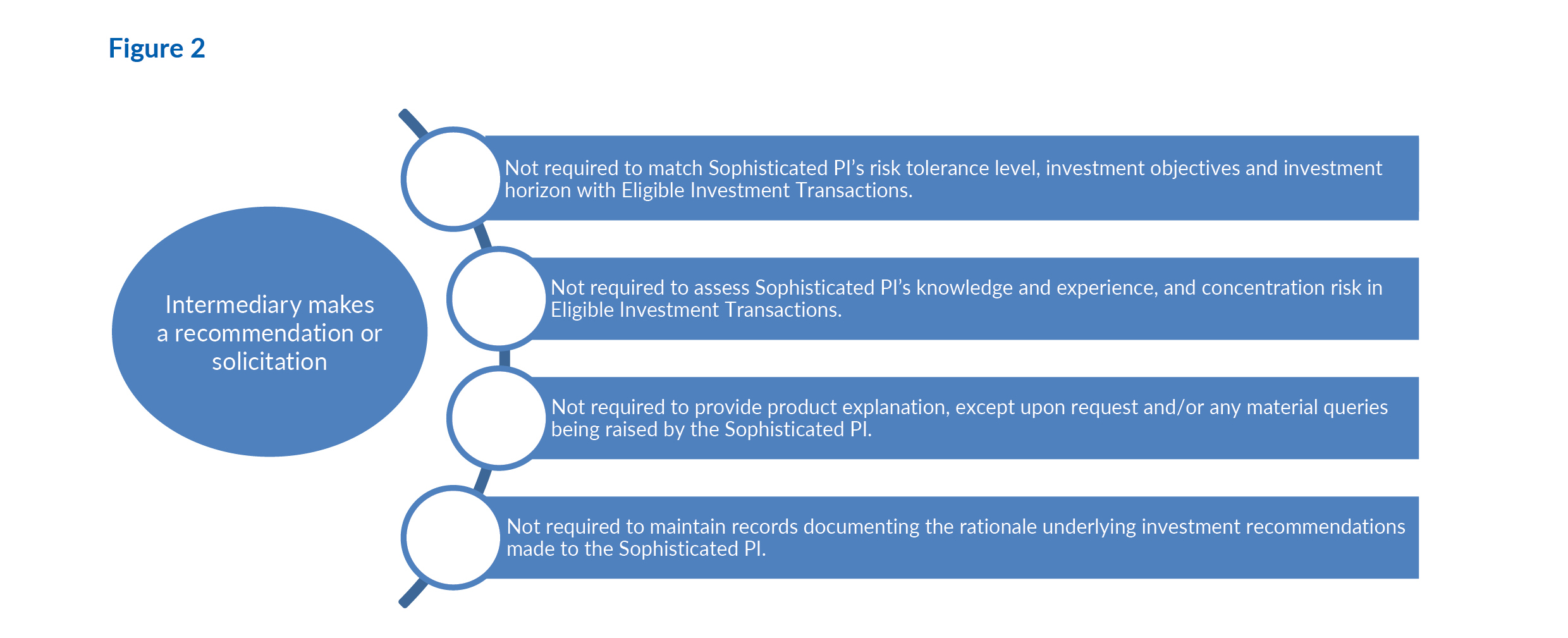

For transactions with a recommendation or solicitation executed under a Streamlined Approach, intermediaries are not required to do the following, as shown in Figure 2.  For transactions in a complex product without recommendation or solicitation executed under a Streamlined Approach, intermediaries are not required to do the following, as shown in Figure 3.

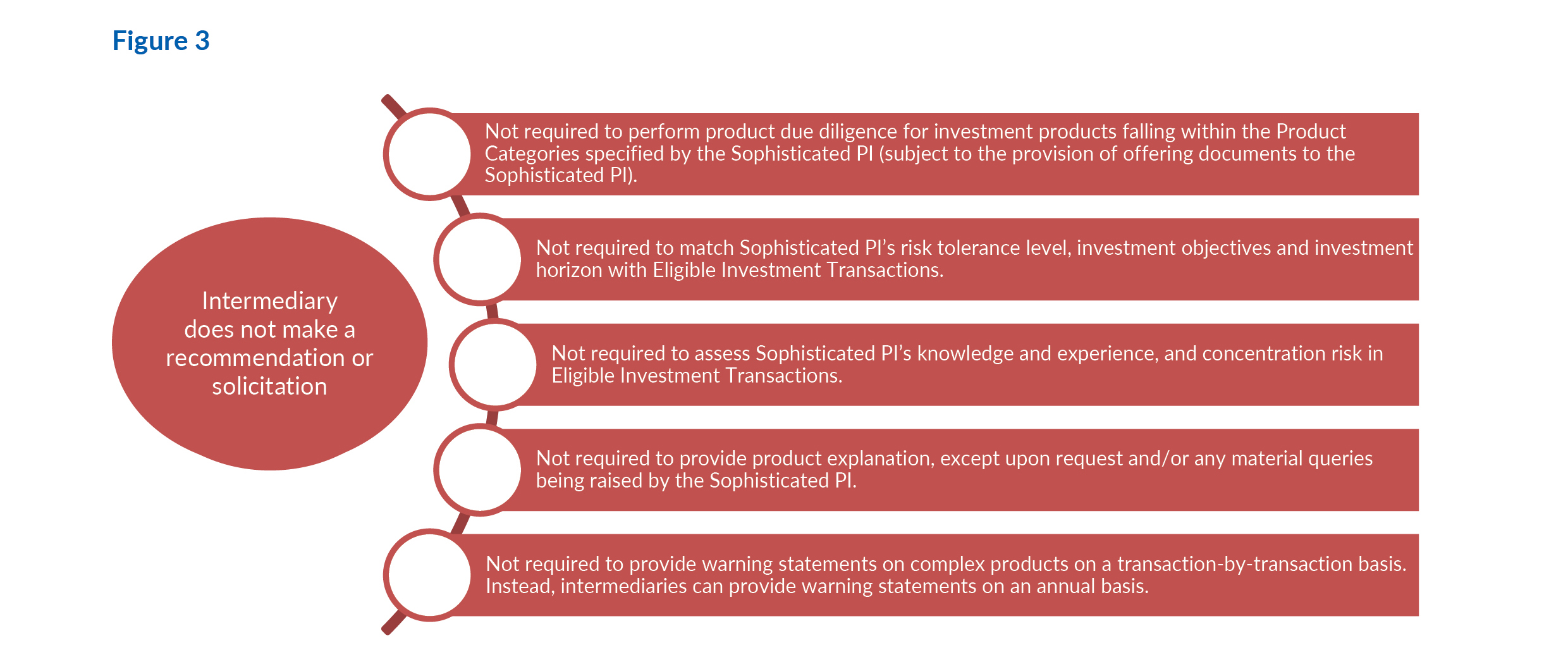

For transactions in a complex product without recommendation or solicitation executed under a Streamlined Approach, intermediaries are not required to do the following, as shown in Figure 3.  To be clear, Sophisticated PIs must still receive up-to-date product offering documents (which can be by electronic means) and other requirements must still be met.

To be clear, Sophisticated PIs must still receive up-to-date product offering documents (which can be by electronic means) and other requirements must still be met.

4. Application of the Streamlined Approach – how should intermediaries implement the Streamlined Approach?

Written Sophisticated PI assessment. An intermediary should apply the Streamlined Approach when dealing with a Sophisticated PI only if the intermediary is reasonably satisfied that the Sophisticated PI has the degree of sophistication to understand and take on the risks arising from a Streamlined Approach by meeting the qualifying criteria (ie, financial situation, knowledge or experience and investment objectives). Intermediaries should keep proper records of its assessments.

Client acknowledgement. Prior to applying the Streamlined Approach, when dealing with a Sophisticated PI in Eligible Investment Transactions, the intermediaries should:

- enter into a written agreement with each Sophisticated PI for acknowledging and giving consent to be treated as a Sophisticated PI

- specify in writing the assessment criteria under which the client qualified as a Sophisticated PI

- specify in writing the Product Categories and the Streamlining Threshold within which investment transactions could be executed under a Streamlined Approach, and

- fully explain to the Sophisticated PI the consequences of being treated as a Sophisticated PI and the Sophisticated PI’s right to withdraw from being treated as such at any time, including those set out in the Circular.

Annual review. Intermediaries must carry out a review annually to ensure that the Sophisticated PI continues to fulfil the requisite requirements (as summarised in section 1 above) and continues to agree that the intermediary execute investment transactions falling within the Product Categories and Streamlining Threshold. In carrying out the annual review, intermediaries should remind the client in writing of:

- the consequences of being treated as a Sophisticated PI

- the Product Categories and related information as contained in the Product Statement

- the Streamlining Threshold and an alert to the Sophisticated PI where there was any instance of breach, and

- the right of the Sophisticated PI to withdraw from being treated as a Sophisticated PI, to add or remove a Product Category and/or to amend the Streamlining Threshold at any time.

Key action points The Circular will be particularly relevant to wealth management and private banking businesses. However, we are also examining its relevance to other emerging asset segments, including virtual assets.

We recommend asking the following key questions:

- Would any of my existing and target new clients satisfy the criteria of Sophisticate PIs and is there are an opportunity to leverage the Streamlined Approach?

- If so, what are the Product Categories that can be offered more widely under the Streamlined Approach?

- Which policies, procedures, systems and documents would need to change?

- Are any operational changes needed and is the overall value proposition of the Streamlined Approach sufficiently strong to justify adopting it?

Richard Mazzochi, Partner, Urszula McCormack, Partner, Cross Border Finance and Technology, Cindy Shek, Partner, and Nikita Ajwani, Associate.

King & Wood Mallesons

Copyright © King & Wood Mallesons, August 2023

More information can be found under the ‘Rules and standards’ page of the SFC website: https://www.sfc.hk/en/.

“the Streamlined Approach supports Hong Kong’s continuing efforts to attract local and international capital – in this case, for the ultra-high net worth market segment”