China is searching for a new growth order for its restlessly expanding cities, suggest Andrew Sheng and Xiao Geng of the Fung Global Institute.

Between 1978 and 2012, China's GDP grew at an average annual rate of about 10% – from US$341 billion to US$8.3 trillion (at 2012 prices) – lifting more than 500 million Chinese out of poverty in the process. Much of this was due to an export-led industrialisation and urbanisation strategy that opened up new opportunities in the rapidly expanding cities, where labour, capital, technology, and infrastructure came together to form supply capacities for global markets.

According to the McKinsey Global Institute, by 2025, 29 of the world's 75 most dynamic cities will be in China.

But this urban-based, export-led growth model also created more challenges than it can now handle: property bubbles, traffic jams, pollution, unsustainable local government debt, land-related corruption and social unrest related to unequal access to social welfare. As a result, a shift toward a new consumption-based growth model – one that emphasises stability, inclusiveness and sustainability – is at the top of China's agenda.

The current economic-growth model considers the configuration of key factors of production – land, labour, capital, and total factor productivity (a measure of efficiency). But this narrow focus on output neglects the economy's human dimension – that is, how growth affects ordinary Chinese citizens’ lives.

A growth order, by contrast, implies an emphasis on the configuration of sociopolitical and economic institutions – including norms, procedures, laws, and enforcement mechanisms – to achieve social objectives, such as improved living standards, a healthier natural environment, and a harmonious and innovative society.

The growth order's stability will depend on institutionalised and effective coordination between the state, the market, and society – a major challenge, given the divergent interests within and among these groups. But, more important, much of the growth order's effectiveness will depend on the relationship between the central and local governments in the delivery of public services for the market.

Indeed, contrary to popular belief outside China, the Chinese state is not monolithic; it is a highly complex bureaucracy with many layers of government and quasi-government institutions that do not always conform to central directives. The central government is in charge of national or systemic interests, deploying legal, regulatory, and broad monetary and fiscal policies to achieve its ends. But the state interacts with private enterprises, individuals, and civil society mainly through local governments and local offices of national regulatory agencies.

A distinctive feature of the Chinese growth order is that local governments compete actively against each other for jobs, revenue, investment, and access to fiscal and human resources. This is because local governments’ leaders are appointed centrally, and, until recently, promotion has been based largely on the ability to generate GDP growth at the local level, leading to over-investment in the economy as a whole.

Hence, the interplay between local and central governments is complex, particularly in terms of revenue sharing and responsibility for providing public services. Although the central government may be committed to reforms, implementation at the local level can be very uneven, owing to parochial and vested interests.

For example, since 2008, when the central authorities tried to boost growth to combat the global crisis, local governments expanded their investment capacity through shadow-banking vehicles that sought to circumvent restraints on bank credit.

Because local governments receive 50% of total national fiscal revenue, but account for 85% of total fiscal expenditure, they try to supplement their budgets through land sales. In 2012, Chinese local governments received RMB2.9 trillion (US$475 billion) in revenue from land and property sales, compared with RMB6.1 trillion in other local revenue.

Compared to the private sector, local governments and state-owned enterprises tend to have access to significantly cheaper funding, with the gap between official interest rates and shadow-banking borrowing costs reaching as much as 10 percentage points. Cheap funding and land revenue have led to excess infrastructure and industrial capacity without adequate market discipline. From 2008 to

2012, fixed-asset investment in China amounted to RMB136 trillion, or 2.6 times more than the country's 2012 GDP.

Rebalancing the economy by shifting toward domestic consumption and avoiding over-investment will require major fiscal and monetary reforms, as well as structural reforms to delineate land-use rights more clearly. It will also require revising the framework for revenue sharing between central and local governments, as well as transparency in local-government finance.

These reforms stand at the center of the state/ market debate, because the private sector, caught in the complex interplay between central/ local power sharing, can easily be crowded out. Thus, creating a new growth order requires the central government to align institutional structures and incentives so that local governments and the market can play to their strengths. The market must be allowed the space to innovate, while the state must implement the necessary institutional and procedural reforms. Striking the right balance between market-based product innovation and state-led institutional innovation will be the main challenge that China faces in the years ahead.

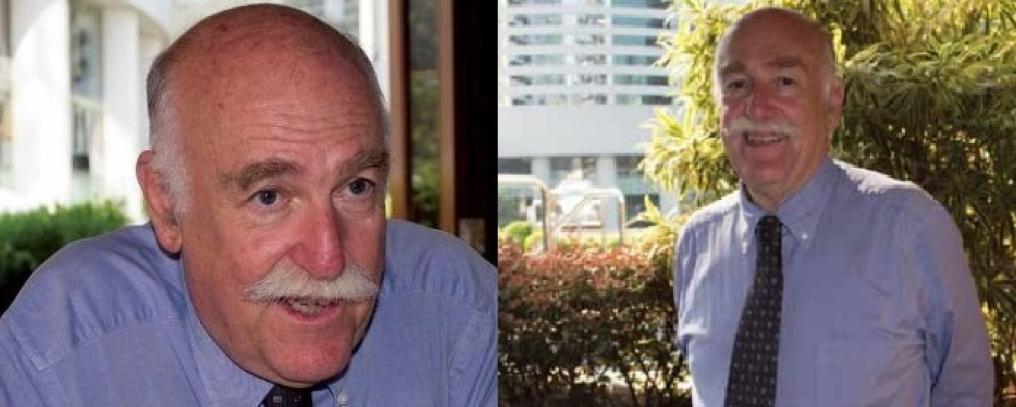

Andrew Sheng

President, Fung Global Institute

Xiao Geng

Director of Research, Fung Global Institute

The Fung Global Institute (www.fungglobalinstitute.org)

is an independent think-tank based in Hong Kong producing research on global issues from Asian perspectives that are relevant both to business leaders and policymakers.

Copyright: Project Syndicate, 2013.

經綸國際經濟研究院的沈聯濤和肖耿認為,中國正為其躁 動不安地擴張中的城市探索新的“增長秩序”。

香港——从1978到2012年,中国 GDP从3410亿美元增长至83000 亿美元(按2012年价格计算),年均 增长10%左右,5亿人口因此脱贫。 在很大程度上,这应当归功于以出口 为导向的工业化及城镇化战略,为快 速扩张的城市开辟了新的机遇。正是 在城市中,劳动力、资金、技术和基 础设施的汇聚,形成了面向全球市场 的供给能力。据麦肯锡全球研究院统 计,到2025年,全球75个最具活力城 市中将有29个在中国。

但这种城市驱动、出口导向的增长模 式也带来了中国难以应对的挑战:房 地产泡沫、交通拥堵、污染、不可持 续的地方政府债务、与土地相关的腐 败,以及社会福利分配不均导致的社 会动荡。因此,中国领导人将其首要 任务定为向(基于消费而非投资的) 稳定、包容、可持续的新型增长模式 转型。中国正在为快速发展的城市探 索新的增长秩序。

当前的GDP-目标增长模式更多考虑了 土地、劳动力、资金和全要素生产率 等关键生产要素配置问题。然而,单 纯重视产出却忽视了以人为本,即经 济发展如何影响普通中国民众的生活 及他们的互动行为。

与增长模式不同,增长秩序意味着为 了达到提高生活水平、改善自然环 境、鼓励创新和建设和谐社会等目标,需要强调社会政治和经济的体制 与制度安排,包括规范、程序、法律 和执法机制。

增长秩序的稳定与否将取决于制度安 排的合理性,以及国家、市场及社会 协同合作的有效性,考虑到这三者间 的利益冲突,他们的协调合作往往不 容易。重要的是,增长秩序的稳定性 将在很大程度上取决于为市场及社会 提供公共服务时中央和地方政府间的 关系及职能分工。

事实上,与国外多数人的看法相反, 中国政府并不是严格遵守中央指令的 铁板一块,而是由不同层级的地方政 府和中央部门及监管机构组成的高度 复杂的官僚体系。中央政府负责国家 或全局利益的事务,通过法律、法规 及货币财政等宏观政策来实现目标。 但国家主要通过地方政府和国家监管 机构的派出机构,与民营企业、个人 和社會之间进行接触互动。

中国增长秩序的显著特点是,地方政 府为争夺就业机会、收入、投资、财 政资源、人力资源等积极展开竞争。 但地方政府的首脑由中央任命。到目 前为止,地方官员的升迁与否主要取 决于其所在地区GDP增长的情况,导致 地方经济整体出现投资过热。

尤其在财税收入分享和公共服务责任 分担方面,地方和中央政府的关系非常复杂。尽管中央政府可能致力于改 革,但由于地方保护主义和既得利益 作祟,改革在地方层面的落实情况可 能很不平衡。

例如2008年以来,当中央政府试图刺 激经济增长以抵御全球金融危机,不 少地方政府却借助影子银行扩大地方 投资规模,以规避宏观经济政策对银 行信贷的约束。

由于地方政府只能拿到50%的全国财政 总收入,却要负担85%的财政支出,所 以,他们试图通过销售土地弥补预算的 不足,以满足社会公共服务与发展性支 出的资金需求。2012年,全国地方政府 通过销售土地及物业实现总收入2.9万亿 人民币,而地方政府其它来源的财政收 入总和才不过6.1万亿人民币。

相比于私营企业,地方政府和国有企业 往往能获得更低利率的资金——官方利 率和影子银行借贷成本之差往往高达十个百分点之多。廉价融资和土地出让收 入导致地方基础设施和产能过剩,缺乏 市場約束。仅2008年至2012年间,中国 固定资产投资总额达136万亿人民币,比 2012年中国的GDP多2.6倍。

实现经济结构调整,转向国内消费及 避免过度投资,需要进行重大的财政和货币改革以及结构转型,这包括更 清晰地界定土地使用权,重新平衡及 界定中央与地方政府的财政收入及支 出责任,并提升地方政府财政及资产 负债的透明度。

上述改革是有关政府与市场关系辩论 的核心议题。私营企业往往被卷入中央与地方复杂的权力分配博弈当中, 并很容易被挤出资金、人才、土地、 及资源市场。因此,建立全新的增长 秩序需要中央政府调整体制结构和激 励机制,以使地方政府和市场能够发 挥各自的优势。必须给市场留出创新 的空间,同时政府必须进行必要的制 度创新和程序改革。这些制度层面的 改革创新只有政府能做。

因此,为实现中国梦,中国面临的主 要挑战将是在以市场为基础的产品创 新和以政府为主导的制度创新之间取 得平衡。关键是让政府职能到位或补 位,而不是越位、错位、或缺位。

沈联涛

院长, 经纶国际经济研究院

肖耿

研究总监, 经纶国际经济研究院 翻译:Xu Binbin

版权所有:Project Syndicate,2013.,