CGj reviews a recent Institute webinar that offered practical recommendations for organisations on how to address the complex and urgent issues surrounding climate change.

Globally, developments relating to climate change and sustainability reporting have been coming thick and fast, but corporate reporting in Hong Kong in general still has some catching up to do with international standards. The potential impacts of climate-related issues on a business, for example, are rarely acknowledged in its financial statements – perhaps because climate change is still considered to be a long-term issue.

A webinar held by the Institute on 5 May 2022 – Climate Change Reporting: Changes Are Coming Quickly – made it very clear that climate change is no longer a long-term issue. The effects of climate change are already upon us and how companies respond to climate issues will increasingly determine their ability to stay in business in the years ahead. Stakeholders, especially those needing to price assets for their financial decisions, and increasingly regulators, already expect to see organisations assessing the financial impacts of climate change. They also want to see the board and senior management reporting on how they are adjusting their strategy and governance processes to tackle the physical and transitional risks that climate change will involve.

The webinar offered practical recommendations on how organisations can understand and respond to these challenges.

Start with the big picture

Kelly Lee, Vice-President, Policy and Secretariat Services, Listing Division, Hong Kong Exchanges and Clearing Ltd, emphasised in her presentation that the first step for organisations, and the governance professionals advising them, is to ensure they are not blindsided by what is coming. In particular, she pointed out that the launch of the International Sustainability Standards Board (ISSB) late last year will have major implications for organisations around the world as the ISSB seeks to establish a comprehensive global baseline of sustainability-related disclosure standards.

‘I think the first step is to get yourself, as corporate governance professionals, your board and your senior management familiar with the new ISSB standards and identify any gaps with your own internal policies. This will help you to plan ahead for any system enhancements in preparation for an upgrade of climate disclosures,’ Ms Lee said.

Other webinar speakers made the point that global convergence to a single standard will certainly be good news for organisations and investors. ‘We really welcome the moves underway to unify all the sustainability reporting bodies under the auspices of the ISSB,’ said David Simmonds FCG HKFCG, Institute Vice-President, and Chief Strategy, Sustainability & Governance Officer and Company Secretary, CLP Holdings Ltd. Prior to the emergence of the ISSB, organisations had to choose between an ‘acronym soup’ of different standards and methodologies, he pointed out. ‘The various reporting standards have overlapped in many ways, they’re inconsistent in some ways. And while each of them has merits to a greater or lesser extent, it’s impossible for any one company to comply with all of them. And it takes too much effort and resources to deal with multiple reporting standards,’ he said.

Pat-Nie Woo, Partner, KPMG China and Head of Environment, Social and Governance, Hong Kong and Global Co-Chair, Sustainable Finance, KPMG IMPACT, added that organisations in Hong Kong can expect the ISSB standards to be adopted in Hong Kong. He cited the way both regulators and the government have been keen to align local regulations with the approach of the Task Force on Climate-related Financial Disclosures (TCFD) and the proposed ISSB standards, currently under consultation, which explicitly build on the TCFD approach. Indeed, TCFD-aligned climate change reporting is expected to be mandatory for all relevant sectors in Hong Kong by 2025 (see: ‘Convergence of regulatory requirements’).

Closing the gaps

As Hong Kong’s regulatory regime converges with the proposed ISSB standards, companies in Hong Kong will be subject to increasing expectations regarding their disclosures on how climate change is impacting, and will impact, their business and how resilient their business model is to those impacts going forward. The webinar sought to give practical advice on how companies can rise to this challenge.

How to get the governance right

A prominent aspect of the TCFD approach is its emphasis on the importance of establishing governance structures within companies to ensure that climate issues are effectively addressed. In his presentation, Mr Simmonds gave a case scenario of how CLP has adapted its governance structure to ensure that ESG, and climate change in particular, gets the attention it deserves at all levels of the company.

‘It won’t surprise you to hear me say that all of this starts with getting the governance right,’ he told webinar participants. ‘To properly address climate reporting really requires a commitment to ensuring that climate issues are incorporated into the corporate agenda.’

To this end, CLP has set up a sustainability committee of the board to look at longer-term ESG issues, climate being a classic example, and how they may impact the company. He explained that getting together a smaller group of directors who are committed and interested in sustainability issues has been highly useful. They can do the ‘heavy lifting’, he said.

He also clarified the division of responsibilities between the board sustainability committee and CLP’s audit and risk committees. While, those latter committees retain the responsibility for the assurance of the sustainability data and the climate metrics used in the company’s reporting, the board sustainability committee focuses on the ‘forward looking’ issues.

Getting the governance right, however, also requires adopting the right mindset, Mr Simmonds added. ‘The mindset that the company has in approaching this task is absolutely critical. And it starts with the question of why you are reporting in the first place. This should not be an opportunity for marketing the company’s green credentials, nor should it be an excuse to just dump data into a report to satisfy a regulatory requirement. I think, fundamentally, climate reporting has got to begin with a proper consideration of the external context – the drivers for climate reporting and how those issues relate specifically to the company,’ he said.

How to get the metrics right

The metrics and targets companies should be disclosing relating to climate change is the area where Hong Kong’s regulatory requirements have the most catching up to do in their alignment with the proposed ISSB standards (see: ‘Convergence of regulatory requirements’). Mr Woo made it clear, however, that one thing is for certain – companies in Hong Kong will be increasingly expected to make their ESG and climate change disclosures more quantitative than they have been in the past.

He acknowledged that this is likely to be a challenge for many companies. Directors are often concerned about the potential legal liabilities involved in making forward-looking statements and are likely to be particularly concerned about having to report on the impact that climate related issues are going to have on the value of their company. In this context, Mr Woo gave webinar participants useful tips on how to use scenario analysis, which involves looking at various future climate scenarios, based on different bands of temperature rise, and assessing how they would impact a company from a physical and a transitional risk perspective.

This might sound daunting, but Mr Woo pointed out that it is not hard to find in the public domain many estimates of the variables involved – for example, the predicted sea level rise in Hong Kong as global warming increases. This is clearly highly material to the physical risks companies with real estate assets in Hong Kong will face as the planet warms, since many of those assets will be close to the seashore.

In the Q&A session, Mr Woo added that the predicted sea level rise in Hong Kong in a three-degree scenario (global warming of three degrees compared with pre-industrial levels is often given as the worst case scenario, but not one that is implausible given current emissions trajectories) would be nothing short of catastrophic for low-lying real estate in Hong Kong. This re-enforces the message that scenario analysis is not just a useful tool for disclosure compliance, but also to help companies really think through what climate change is going to mean for their continued ability to stay in business.

Another consideration for companies assessing the financial impacts of future climate scenarios is that of materiality. Wei Lin, Partner, Head of ESG and Head of Strategy & Operations, KPMG Advisory (China) Ltd, who joined the webinar as a panellist, added his insights on this question.

‘I think companies will find that engaging a wider set of stakeholders will be a useful starting point for identifying all of the significant climate-related risks and opportunities they need to take into account when assessing materiality,’ he said. The ISSB/TCFD approach is geared towards ensuring investors get the information they need, but there is of course a wider set of stakeholders interested in the impacts of climate change – such as employees, customers, business partners and regulators.

The value of cross-functional collaboration

Given the above discussion of the way metrics and targets will be heading in the years ahead, Mr Woo added that the finance function needs to be more involved in sustainability reporting. ‘It’s no longer good enough to just have a few people within an organisation doing an ESG report. There needs to be a cross-departmental group looking at this and the finance department needs to get a lot more involved,’ he said.

He pointed out that the TCFD/ISSB approach focuses on the financial impacts of climate change on business models. ‘It’s not just about disclosing ESG reports anymore, it is about how ESG is impacting enterprise value,’ he said. In other words, stakeholders need to know how these impacts are going to affect the business from a valuation standpoint, from a cashflow standpoint and from a business model standpoint.

Time is running out

Finally, the webinar also emphasised the urgency of taking the steps described above. ‘The ESG space is evolving very quickly and it is very important for everyone to keep abreast of the latest developments and seek training and guidance where necessary,’ Ms Lee said.

Mr Woo echoed this point. ‘The market is not going to let people get used to the new requirements simply because we’ve responded to this crisis way too late – organisations need to move fast on this,’ he said.

Mr Simmonds added that the pathway for companies with poor ESG credentials will become increasingly unviable. Climate, he pointed out, has now become a mainstream investor concern. Moreover, banks, insurance companies and other market players have developed climate policies that are becoming increasingly strict in their requirements and application. Companies that don’t meet those requirements could therefore find their access to capital, insurance and other financial products cut off. Companies without a viable climate plan could also find themselves the target of activist investors or other stakeholders agitating for change.

On the other hand, he added that even if companies do not have all the answers to the questions stakeholders are asking, and if they do not meet all the requirements, they at least need to have a plan to move in the right direction. ‘Your reporting provides a really valuable opportunity to align the market behind the direction that you’re taking as a company. If there’s one key message that I’d like to leave you with today, it is that this trend is not going to reverse. Hong Kong companies are going to have to get used to a much higher standard of climate reporting in the years ahead,’ he concluded.

SIDEBAR: Convergence of regulatory requirements

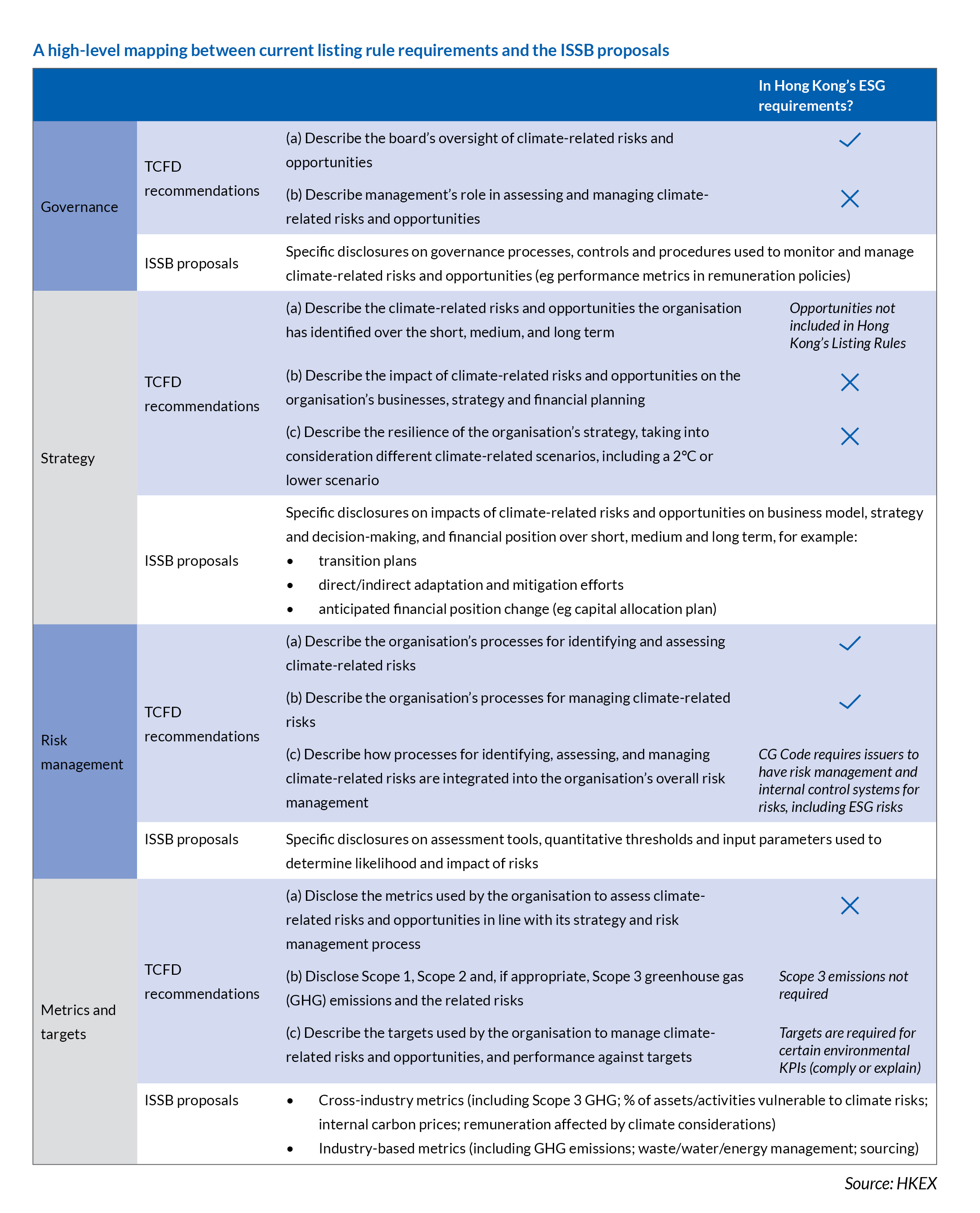

As mentioned in the main article, the launch of the International Sustainability Standards Board (ISSB) will have major implications for climate-related disclosure requirements around the world. The proposed ISSB standards, currently under consultation, build on the approach of the Task Force on Climate-related Financial Disclosures (TCFD), which identify climate-related disclosures from the perspective of four pillars– governance, strategy, risk management, and metrics and targets.

In the webinar, Kelly Lee, Vice-President, Policy and Secretariat Services, Listing Division, Hong Kong Exchanges and Clearing Ltd, discussed the gaps that exist between the local and international requirements in these four areas. Regarding risk management, Hong Kong’s current ESG requirements are largely aligned with the ISSB proposals. Regarding governance, while Hong Kong is already largely aligned with the proposed requirements, the ISSB proposes more specific disclosures on companies’ relevant governance structures. It would also require disclosure of management’s role in assessing and managing climate risks and opportunities.

The most notable gaps exist in the two other pillars – strategy, and metrics and targets.

Strategy. The ISSB model will require companies to report on the risks and opportunities of climate change on the company’s business model (including how this might impact its financial performance over the short, medium and long term) and the company’s strategy for climate resilience (including the use of scenario analysis). These are not currently part of the Hong Kong regime.

Metrics and targets. The ISSB will require Scope 3 emission disclosures. ‘Scope 3’ refers to emissions that are the result of activities from assets not owned or controlled by a company, but that it indirectly impacts in its value chain. Alignment with this requirement would significantly expand the scope of climate reporting required of Hong Kong companies.

‘Going forward, we believe that it’s time for us to conduct a review of our current ESG framework to see how we can further align with the TCFD and the new ISSB standards to enhance our climate disclosures required from our listed companies. The focus area will be on gaps such as the need for scenario analysis, Scope 3 emissions and companies’ transition plans to a low-carbon economy,’ she said.