Climate change disclosures – is the world too focused on this topic?

In this second and final part of the Best Paper of the Institute’s latest Corporate Governance Paper Competition, the authors provide justification for their stance that that the world is not too focused on climate change disclosures, but rather that it is still in its infancy, and envisage the future direction of climate change disclosure as we shift to a more sustainable future.

Highlights

- there is a wide gap between the increased coverage of climate change disclosure and the quality of that reporting, which remains a major concern, indicating that disclosure is still at an immature stage

- climate change disclosure significantly contributes to the promotion of green and sustainable finance in the global investment market, benefiting businesses, investors and geopolitical stability in the long term

- by providing a more comprehensive picture of a company’s ESG risks and opportunities, technological advancements – including AI – may help prevent a disproportionate focus on climate change disclosure and ensure a broad range of sustainability issues is being addressed

The Institute’s annual Corporate Governance Paper Competition and Presentation Awards has been held since 2006 to promote awareness of corporate governance among local undergraduates. In 2023, the theme of the paper required students to discuss the issue of climate change disclosure and if the world is too focused on this topic. Part one, published in last month’s journal, explored the current environmental, social and governance (ESG) regimes on a global basis and whether the world is excessively preoccupied with climate change disclosures.

Justifications for upholding our stance

With the widespread adoption of extensive climate change disclosure, it might appear that the world has become overly fixated on this issue. Yet, this proposition is countered by the following arguments.

Climate change disclosure as one of the green measures

Climate change disclosure is not the sole approach to achieving a green economy under the ESG frameworks. Other ways the world has emphasised this include the imposition of carbon tax, investing in energy transition and signing of cross-border agreements.

Carbon pricing is an effective economic signal to hold businesses accountable for their emissions and to encourage consumers to shift away from carbon-intensive goods and services, underpinning climate mitigation efforts. Singapore, Finland, Norway and Sweden are some jurisdictions where a carbon tax has been implemented. Take Singapore as an illustration. The Carbon Pricing Act was amended on 7 March 2023 to progressively increase carbon tax rates. Currently, 80% of the total national greenhouse gas (GHG) emissions from around 50 facilities in the power, water, waste and manufacturing sectors are covered by the carbon tax. It is undisputed that carbon tax plays a critical role in encouraging companies to adopt cleaner practices and reduce carbon emissions to cut costs, and in promoting sustainable customer behaviour by increasing the cost of carbon-intensive goods and services. Thus, carbon tax appears to be given much weight in forming part of a comprehensive suite of mitigation measures to support the global transition to a low-carbon economy.

Very often, the driving force behind business efforts is the government, which takes a leading role in fostering clean energy manufacturing by creating new opportunities to innovate. The Mainland, the biggest emitter of GHGs in 2021, topped the world in clean energy investment in 2022. With approximately half the world’s low-carbon spending taking place in the Mainland, the country spent US$546 billion in 2022 on investments such as electric vehicles, batteries and renewables. In particular, much capital was allocated to developing renewables. In 2022, coal was used to generate more than half the national electricity, causing coal burning to become the major cause of global warming in the Mainland. To alleviate reliance on coal, the country’s Ministry of Finance has set the renewable power subsidy at US$607.26 million, which was allocated to wind farms, solar power stations and biomass power generators. Therefore, investment in energy transition is also at the heart of global green measures.

Intergovernmental collaboration is also of great significance in cultivating a global resilient corporate market amid the climate crisis. The Singapore–Australia Green Economy Agreement (GEA), signed by their respective trade ministers on 18 October 2022, is the world’s first agreement combining trade, economic and environmental objectives. By reducing barriers to the trade in green goods and services, the GEA has resulted in a higher availability of environmentally friendly goods and services in the markets of Singapore and Australia. The GEA also boosts regulations and benchmarks that facilitate cross-border green activities, and support the advancement and commercialisation of green technologies. This could create favourable conditions for businesses and research institutes to collaborate with foreign partners, explore overseas investment opportunities and implement innovative technologies on a greater scale. The binding cross-border agreements could link like-minded international partners to contribute to the global disclosure on the environment and the economy, as well as to enhance global capacity to address climate change.

allocating more resources towards climate change disclosure is a rational and proportional response

Nature of climate change disclosure justifies increased resource allocation

Considering the pressing nature of climate risks and the significant benefits arising from climate change disclosure on social, political and environmental aspects, allocating more resources towards climate change disclosure is a rational and proportional response.

Climate change is an imperative and irreversible crisis that necessitates immediate global action. According to a report by the Intergovernmental Panel on Climate Change in August 2021, the current rate of global warming has been described as a ‘code red for humanity’. Despite current commitments to climate mitigation, global GHG emissions are projected to drop by only 1% by 2030. This falls short of the United Nations (UN) Net Zero Coalition’s target of 45% reduction by 2030 to limit global warming to 1.5°C – thus, achieving the goals of the 2015 Paris Agreement will be beyond reach. The data therefore suggests that there is a need for rapid and deep reductions in GHG emissions in the upcoming decades.

As the UN has stated that the transition to a net zero global economy requires a minimum of US$90 trillion, the capital market will play a crucial role in attracting related large-scale investments. Climate change disclosure significantly contributes to the promotion of green and sustainable finance in the global investment market, benefiting businesses, investors and geopolitical stability in the long term.

First, climate scenario analysis helps businesses facilitate risk management or even foresee business opportunities. The 2°C scenario, a widely recognised threshold for limiting the growth of climate change, helps businesses to effectively identify and evaluate the potential impacts of climate risks on their business performance under a reasonable diversity of possible future climate states. This assists companies in mapping out strategic and financial plans resilient to climate change. The analysis could also project future business opportunities in emerging green markets, including but not limited to waste recycling, energy storage and green buildings. These markets are foreseen to be worth US$10.3 trillion to the global economy by 2050. Second, transparency and accountability in climate-related reporting can boost companies’ reputations by demonstrating their commitment to sustainability and responsible business practices. Aside from attracting more capital from investors, such an approach helps retain employees and business partners who are concerned about environmental issues. Third, by providing clear and consistent climate-related data, climate change disclosure enables investors to make more informed decisions about where to allocate their capital. This allows investors to assess and compare different companies’ financial exposure and risk management strategies in the long run, leading to more effective investment decisions. Fourth, climate change disclosure is likely to reduce geopolitical conflict. By building a common understanding of the challenges and opportunities associated with climate risks, different corporate sectors and countries can work hand in hand to address climate issues on a global scale. This is liable to reduce disagreements and conflicts that may arise due to differing priorities and perspectives, thus promoting a more sustainable global economy.

Climate change disclosure is in its infancy

Despite gaining increasing attention in the business world, climate change disclosure is still in its early stage of development, regardless of whether it is in developed, developing or underdeveloped jurisdictions. The following demonstrates that achieving a sustainable global economy with the use of climate change disclosure will be a gradual and long-term process.

While well-developed jurisdictions are stepping forward to bring the city-state in line with global standards, the scope of mandatory climate change disclosure remains limited since it only applies to certain sectors or companies. The UK, as the first G20 country to mandate climate change disclosure, only requires Britain’s largest businesses to disclose climate-related financial information, commencing from April 2022. A similar case occurs in Hong Kong, Australia and Singapore. Starting from January 2024, mandatory climate change disclosure will apply to all listed companies in Hong Kong, while in Australia, large listed entities and large financial institutions will be required to disclose climate risks from the 2024/2025 financial year. In Singapore, only listed businesses in the finance, agriculture, energy, materials and transportation industries are required to prove full climate disclosures at present, while listed companies in other industries must follow the ‘comply or explain’ approach. Nonetheless, it is worth noting that Singapore also aims to make climate change disclosure mandatory for unlisted companies by fiscal 2030, as announced by the Sustainability Reporting Advisory Committee on 6 July 2023.

With fewer resources and capital, the less affluent and underprivileged countries will likely be more vulnerable to the impacts of climate change as they have less capacity to adapt and mitigate climate risks. Yet, the coverage of climate change disclosure is even narrower there, compared to wealthier countries. For example, in 2022, the Securities and Exchange Board of India introduced mandatory climate change disclosure under the new Business Responsibility and Sustainability Report, applying only to the top 1,000 listed companies. In South Africa, the government encourages businesses to make climate change disclosure in line with the Task Force on Climate-related Financial Disclosures (TCFD) framework, however it has not made TCFD reporting mandatory. The above suggests that there is still room and potential for uniting the pace of developing a comprehensive climate change disclosure across the globe.

Besides, although more companies have taken part in climate change disclosure worldwide, the quality of the reporting remains a major concern. The fourth EY Global Climate Risk Barometer revealed that of the corporate reports analysed, while the score for coverage of climate change disclosure was 84% in 2022, the average score for quality was merely 44%. The wide gap between coverage and quality implies that some companies are not providing useful disclosures, or could even be practising greenwashing by making false disclosures. This indicates that climate change disclosure is still at an immature stage at present, especially in terms of lacking scrutiny regarding the quality of reporting.

Future direction

Call for continued focus

In response to mounting pressure from investors, governments and other stakeholders to prioritise sustainability, organisations will inevitably continue to place a strong focus on climate change disclosure. As a result of heightened scrutiny, businesses are now more motivated to put responsible practices first when making decisions about operations and expenditures. Regulation and policy should nonetheless continue to drive the incorporation of climate change disclosure and ESG into corporate strategy. Recommended climate change disclosure contents may be adopted by organisations in the framework of governance, strategy, risk management, and metrics and targets, as discussed in part one under Governance.

Research and development (R&D) teams may further play an important role in retaining industry’s focus on climate change disclosure through advancing sustainability practices. For example, R&D teams in automotive companies could develop electric or hybrid vehicles that reduce GHG emissions, while those in home appliance companies could develop energy-efficient products that reduce energy consumption. R&D teams could also collaborate with external stakeholders, such as universities and research institutions, to develop new solutions to environmental challenges. Companies can lessen their environmental effect while offering customers more sustainable options through developing these products. As a consequence, businesses would be able to disclose more precise and in-depth information in their climate change disclosures, thus propelling such disclosure practices forward.

Strike a balance

As justified above, the world is not overly concerned with climate change disclosure. Besides, there are adequate existing resolutions to prevent any overemphasis. Several regulatory bodies around the world, such as those identified in part one of this article under Environmental, have established frameworks and guidelines for climate change disclosures. It should be noted that these regulatory bodies not only provide regional and global frameworks for companies to report on climate change sustainability-related risks and opportunities, they also work to strike a balance between addressing climate change and addressing other crucial ESG issues in order to steer clear of any overemphasis. For instance, CDP Worldwide (CPD) provides businesses with a framework for disclosing their carbon emissions and risks associated with climate change. CDP also addresses additional ESG problems, ranging from supply chain management to water management. Instead of focusing merely on combating climate change, businesses can more thoroughly assure that they address a broad spectrum of ESG issues by adhering to the CDP framework.

Steps ahead

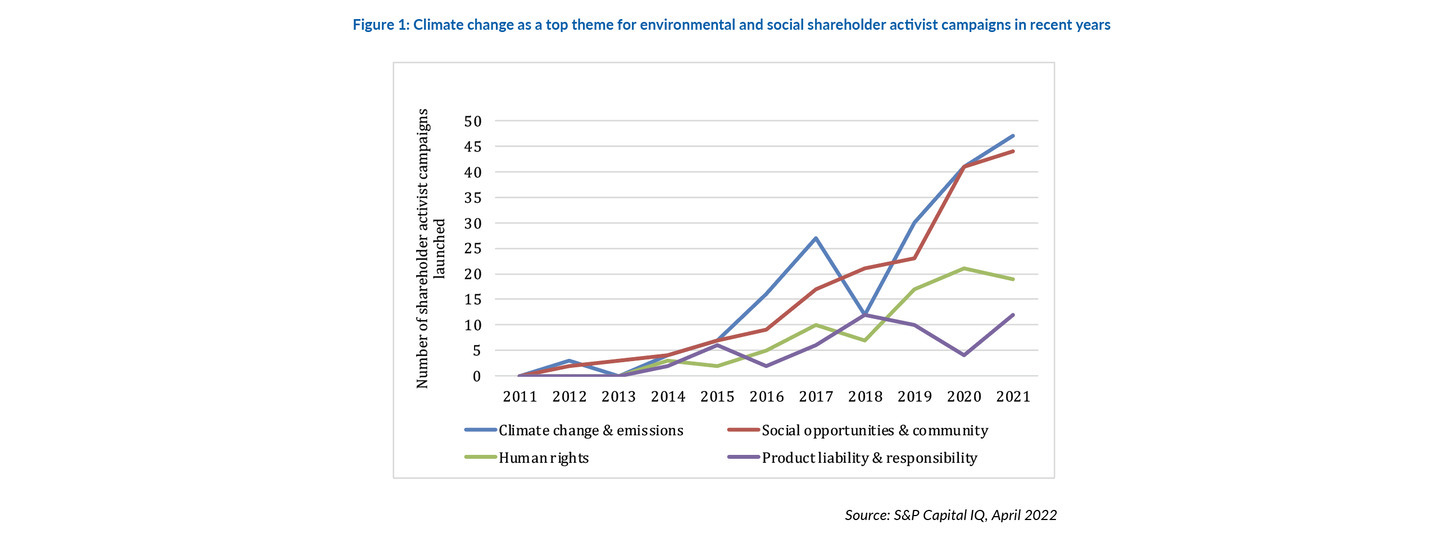

In support of existing resolutions it is proposed that, in the future, shareholder activism will revolutionise how firms approach ESG problems. Corporate disclosure of climate risks has been compelled by shareholder activism, with climate change themes at the top of shareholder activist campaigns in recent years (see Figure 1). This makes it harder for businesses to skirt these issues if they wish to remain competitive. To this end, dialogue with stakeholders can build confidence between companies and their external constituencies, while providing invaluable insights into potential improvement areas related to climate change disclosure objectives.

On top of that, it is submitted that technological advancements like artificial intelligence (AI), machine learning, blockchain, big data analytics and natural language processing designed specifically for climate change disclosures may enhance the precision and effectiveness of presenting such disclosures. These technologies can also be used to automate the monitoring and reporting of ESG metrics across all levels of an organisation’s operations to ensure transparency. Furthermore, in terms of satellite data analysis as a cutting-edge technology, a variety of environmental variables, including carbon emissions, deforestation and air quality, may be monitored in real-time. AI algorithms can then be used to analyse financial data and identify companies that are exposed to climate-related risks, such as those in high-carbon industries or those with significant exposure to climate-related disasters. Such information can be used by investors and other stakeholders to make informed decisions about their investments and to encourage companies to improve their sustainability practices. Also, to spot gaps or inconsistent disclosure, natural language processing algorithms can be employed when reviewing ESG reports and other sustainability-related materials. By providing a more comprehensive picture of a company’s ESG risks and opportunities, AI may help prevent a disproportionate focus on climate change disclosure and ensure a broad range of sustainability issues is being addressed.

Overall, advanced technology has the potential to revolutionise climate change disclosure by providing more comprehensive information on environmental impact, identifying climate-related risks and opportunities, and improving sustainability practices to ensure an equitable focus on sustainability in lieu of simply climate change. Nevertheless, it is of utmost importance to make sure that governments and businesses use emerging technologies with integrity and responsibility, and that its use in promoting climate change disclosure is transparent and accountable.

Conclusion

As the globe grapples with the ripples of climate change, an immediate response is needed to this worldwide catastrophe. Climate change disclosure serves as an essential tool for companies to address the challenges and opportunities associated with climate change, and to promote transparency and accountability in their operations. With the goal of tackling the global challenge of climate change, which was stated as SDG 13 (Climate Action) in the 2030 Agenda for Sustainable Development, an assortment of regimes is currently available in various jurisdictions, delivering frameworks and guidelines for businesses’ climate change disclosures and sustainability practices. In conclusion, it is our stance that the world is not too focused on climate change disclosures, but rather that it is still in its infancy. As we pursue our transition to a more sustainable future, continuing our focus on climate change disclosures with extra support from technological advances is unequivocally a step towards the ideal path.

Yannie Kum and Selina Wu

The University of Hong Kong

This two-part article is the winning paper of the Institute’s annual Corporate Governance Paper Competition for 2023, titled ‘Climate change disclosures: an overlooked priority in the world’s agenda?’, under the theme ‘Climate change disclosures – is the world too focused on this topic?’ More information on the competition and the full version of the Best Paper, along with those from the First Runner-up and Second Runner-up, are available under the Studentship section of the Institute’s website: www.hkcgi.org.hk.