Cultivating independence of mind – ACRU 2017 review: part one

Wednesday | 12 July 2017

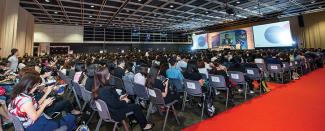

The importance of cultivating an independent mindset for both independent non-executive directors and the company secretary emerged as a central theme of this year's Annual Corporate and Regulatory Update seminar, held last month at the Hong Kong Convention and Exhibition Centre.

Every year, the Institute's Annual Corporate and Regulatory Update (ACRU) seminar provides an ideal opportunity for practitioners, senior managers and directors to enter into a direct dialogue with Hong Kong's major regulatory bodies about the issues at the top of both regulators’ and regulatees’ agendas. The 18th ACRU, held on 2 June at the Hong Kong Convention and Exhibition Centre, did not disappoint. Our review of the event will first focus on the main themes to emerge from the presentations and Q&A discussions, and then turn (see the following cover story on pages 18–22) to look in more detail at the specific governance and compliance issues that regulators highlighted at the event.The role of the board

‘Issuers are run by people,’ Kenneth Chan, Senior Vice-President, Compliance and Monitoring, Listing, Hong Kong Exchanges and Clearing Ltd (the Exchange), pointed out in his ACRU presentation, 'and we expect them to have a good character, integrity and competence, and we expect them to fulfil their duties of skill, care and diligence. In short, we have high expectations of directors.’ Kenneth Chan's presentation focused on 'directors’ suitability’ – the need for the individuals in these roles to have the requisite integrity and skills. He cited a recent case where the Exchange opposed the appointment of a director to a company listed on the Exchange since he had, only one year previously, been found to be actively involved in market manipulation activities and sanctioned with a heavy fine by an overseas securities regulator. Stephen Jamieson, Senior Vice-President, Head of Enforcement, Listing, the Exchange, focused his ACRU presentation on the need for directors to understand and fulfil their duties. 'It is quite surprising the number of cases where directors do not understand their obligations to comply with the listing rules,’ Mr Jamieson said. In fact, directors’ duties has been the single most common theme of the Exchange's enforcement activities over the last year (see 'Top enforcement themes for the Exchange' on page 17). As an example he cited the case of Mei Ping, former Executive Director of China Nonferrous Metals Company Ltd. Mr Mei executed a number of guarantees as a legal representative of the issuer's subsidiaries for loans borrowed by another company of which he, together with his brother, were directors and substantial shareholders. The guarantees therefore constituted a major and connected transaction, but Mr Mei did not inform the board of the transaction, nor did he obtain board approval. His actions contravened almost every GEM listing rule relating to directors’ duties, failing to:- act honestly in good faith in the interests of the issuer as a whole and for proper purpose

- properly apply the issuer's assets

- avoid conflict of interest and duty

- fully disclose his interest, and

- apply the skill, care and diligence expected of him given his knowledge, experience and his role as compliance officer of the issuer.

The role of INEDs

Corporate governance systems around the world, including in Hong Kong, have been vesting increasing importance in the role of independent non-executive directors (INEDs) on boards as a way to bring objectivity and a wider perspective to board discussions. Trevor Keen, Head, Financial Market Infrastructure Oversight & Licensing, and Sarah Kwok, Head, Banking Conduct, at the Hong Kong Monetary Authority (HKMA), addressed the theme of 'INED empowerment and bank culture' in their ACRU presentations. The HKMA has been promoting best practice for INEDs for some time, working closely with banks in Hong Kong to ensure that individuals taking up INED roles have the right combination of skills and qualities. Ms Kwok stressed that, in addition to the appropriate experience and expertise, INEDS need to have integrity and the right personal qualities for the role. These qualities are essentially an independence of mind and a willingness to challenge management. 'INEDs need to constructively challenge management,’ she said. 'They also need to have the ability to exercise objective, independent judgement after fair consideration of all relevant information and views, without undue influence from executives or from external parties.’ She added that this 'independence of mind’ is crucial since INEDs need to protect the interests of all shareholders, depositors and customers and ensure that the company conducts its business in the wider public interest. Mr Keen discussed the time commitment required for an INED position. The INED role is demanding, Mr Keen pointed out, and prospective INEDs may underestimate the time they will have to commit. 'Board and committee meetings, reading and preparation, understanding the business of the bank, keeping up with regulatory and industry developments all take time, especially for non-bankers,’ he said. Stephanie Lau, Senior Vice-President, Compliance and Monitoring, Listing, the Exchange, focused on the critical role played by INEDs in ensuring that connected transactions are conducted in compliance with the listing rules. 'The Exchange is concerned that INEDs all too often simply rely on information supplied by management when performing their connected transaction reviews,’ she said, 'and that some issuers fail to provide reliable information on the fairness and reasonableness of connected transactions to their INEDs.’ The Exchange recommends INEDs to exercise independent and objective judgement and recommends issuers to provide their INEDs with better quality information in order for them to monitor and perform their review of connected transactions.The role of the company secretary

This year's ACRU saw an increased focus on the role of the company secretary, in particular the company secretary's role in providing governance advice and board support. 'How company secretaries can support directors’ was the theme of the presentation by Katherine Ng, Senior Vice-President and Head of Policy, Listing, the Exchange, in the first session of the day (see pages 6–11 of this month's journal for her insights on this topic). Her colleague at the Exchange, Stephen Jamieson, made the point that company secretaries should not neglect their critical role in advising directors on their obligations under the listing rules and their obligation to cooperate with the Exchange's investigations. Eugene Goyne of the SFC pointed out that the new focus of regulators in Hong Kong on enforcing individual accountability of both directors and senior management will be particularly relevant to company secretaries, not only due to their own higher liability, but as a highly persuasive tool they can use to get the governance message across to board directors. The presentations by Trevor Keen and Sarah Kwok of the HKMA also provided useful insights into the board support role of company secretaries. They made the point that one of the key factors in improving the effectiveness of directors generally, and INEDs in particular, is the level of support they receive from the company secretary. Since INEDs will rarely have the same level of knowledge as executive directors of the company's business, Ms Kwok stressed that the induction and ongoing training facilitated by the company secretary is a crucial part of making INEDs effective members of the board. She recommended that company secretaries provide regular briefings on operations and risk management, as well as briefings on wider developments in the industry and regulatory requirements. Mr Keen stressed the importance of good practices in the management of board meetings, such as:- planning meeting schedules well ahead and avoiding making changes unless really necessary

- providing clear board papers that avoid overly technical language

- providing briefings ahead of meetings where required

- facilitating tele- or video-conferencing where physical attendance is impossible

- facilitating access to professional advice, and

- ensuring that board and individual evaluations are carried out at least once a year.