As the digital nomad lifestyle becomes increasingly mainstream, authors at Alvarez & Marsal Tax explore how individuals and employers can navigate complex tax obligations, legal risks and visa requirements across jurisdictions.

Highlights

- tax residency rules and income tax obligations vary across jurisdictions such as Hong Kong, Australia, Canada and the UK

- a digital nomad’s presence in a foreign country can inadvertently create a permanent establishment, exposing their employer to local corporate tax

- there are legal and reputational risks of failing to comply with visa requirements when working across borders

Background

In a world where many types of work can be done from virtually anywhere, the rise of the digital nomad has transformed the concept of a traditional job. Picture this – a talented professional, laptop in hand, sipping coffee at a beachside café in Bali or exploring the bustling streets of Tokyo, all while earning a living. This lifestyle, once limited to tech-savvy programmers and creative designers, is now attracting a diverse range of professionals eager for flexibility and adventure.

The Covid-19 pandemic accelerated this trend, prompting many traditional workers to embrace remote work and the freedom it offers. However, while the allure of a nomadic lifestyle is undeniable, navigating the complexities of tax obligations and legal requirements can be daunting. Both digital nomads and their employers must tread carefully to ensure compliance with local laws and regulations.

In this article, we will discuss the key tax obligations that digital nomads and their employers face.

Individual tax obligations

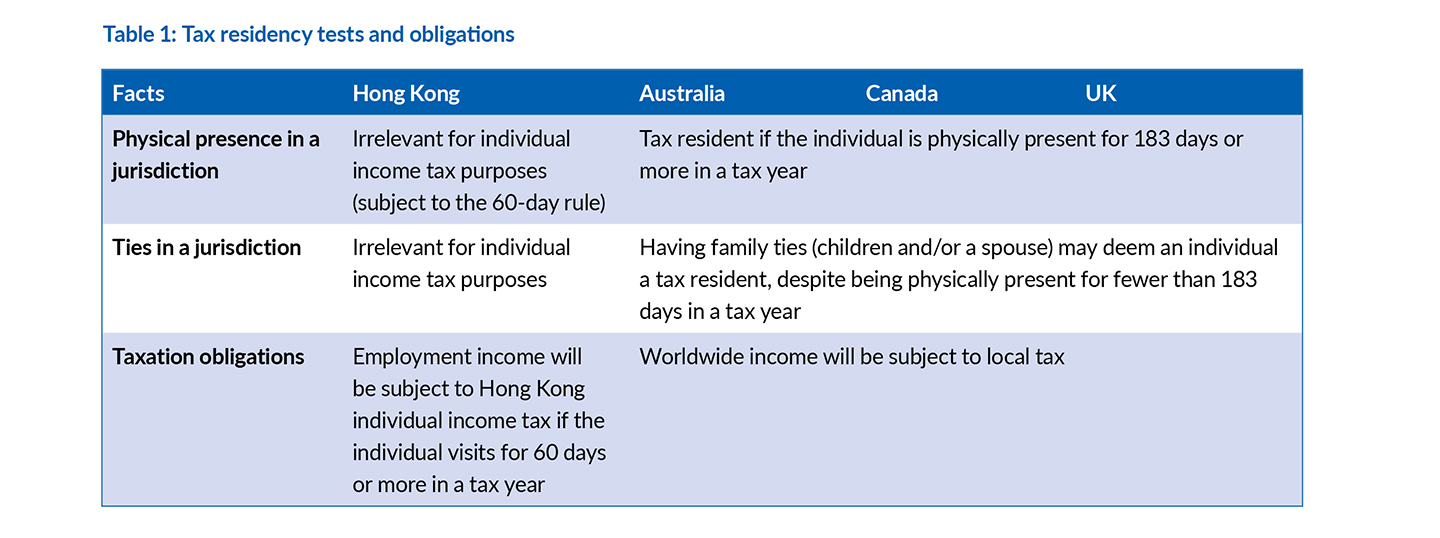

An individual’s employment income is generally taxable based on either their tax residency or the source of their income. Different jurisdictions have varying criteria for determining tax residency, often focusing on physical presence and personal ties.

Table 1 provides a high-level and general summary of tax residency tests and obligations in Hong Kong, as well as in Australia, Canada and the UK. These jurisdictions are particularly relevant for Hong Kong digital nomads, as it is common for Hong Kong families to send their children to study in those jurisdictions, and Hong Kong parents often accompany their children abroad for a period while retaining their working positions in Hong Kong.

Digital nomads should pay specific attention to the number of days they stay in a particular jurisdiction, as it could impact their tax residency status and consequently their tax position in that jurisdiction. This is particularly important for Hong Kong digital nomads as the individual income tax rates in those foreign jurisdictions are generally a lot higher than in Hong Kong, especially if the individual is not able to claim a foreign tax credit in the foreign jurisdiction on the Hong Kong tax paid. Additionally, if an individual engages in profit-generating activities in a particular jurisdiction, it may bring their employer into the local tax net by way of a permanent establishment (PE).

A PE is typically defined as a fixed place of business through which a company conducts its operations. This can include offices, branches or employees conducting business operations in another jurisdiction. For example, a digital nomad working in a hotel, a temporary shared office or a coffee shop could potentially create a PE in that jurisdiction.

Nonetheless, having a PE in Hong Kong does not necessarily mean that the profits will be taxable, unless the profits are arising or derived from Hong Kong. In contrast, in jurisdictions such as Australia, Canada and the UK, income arising or derived from the PE alone will be subject to corporate income tax in the local jurisdiction.

“A digital nomad working in a hotel, a temporary shared office or a coffee shop could potentially create a permanent establishment in that jurisdiction.”

Overview of the Hong Kong tax obligations for employees and employers

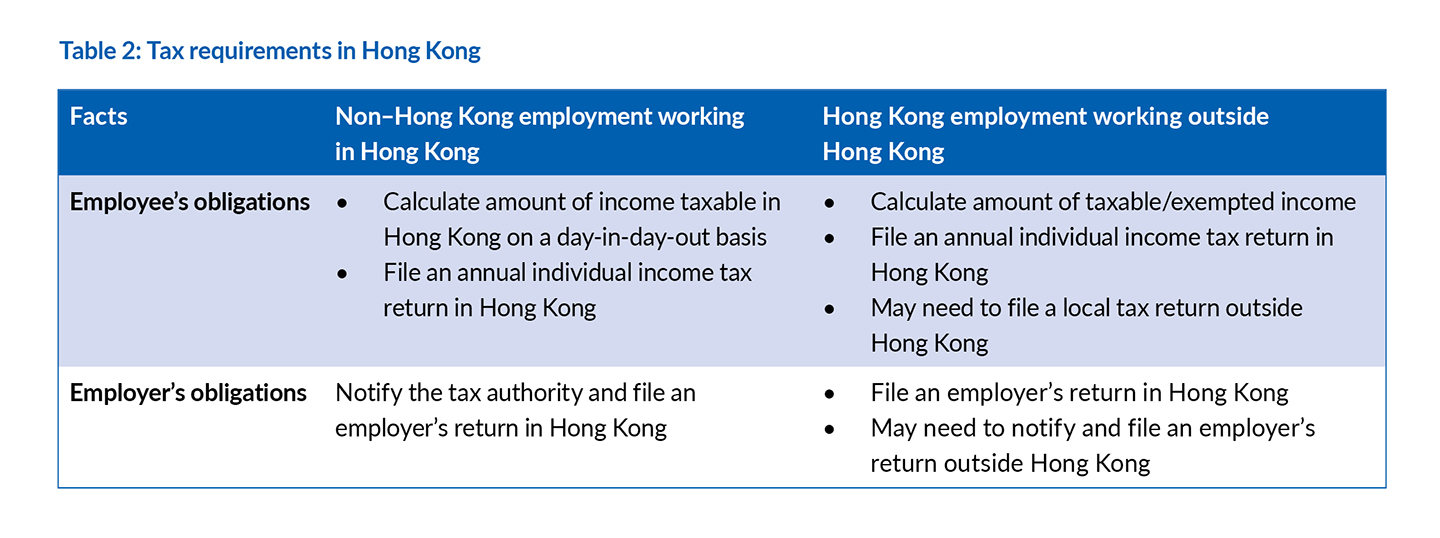

Given these considerations, it is important to explore the tax obligations for employees and employers, using Hong Kong, Australia, Canada and the UK as examples, to understand how they may be affected by an individual’s residency and activities.

To illustrate these obligations, let us take a closer look at the tax requirements in Hong Kong for employees and employers in the following common scenarios, as illustrated in Table 2.

A closer look at employee tax obligations in Hong Kong

Scenario 1 – individual with non– Hong Kong employment working in Hong Kong

For digital nomads employed by companies outside Hong Kong, their employment income is typically assessed on a day-apportionment basis. However, if they do not stay in Hong Kong for more than 60 days within a year of assessment (that is, a full tax year), their entire employment income will be exempt from individual income tax.

In the event that the digital nomad stays in Hong Kong for more than 60 days in a tax year, he or she will be responsible for reporting the income to the Hong Kong tax authority and paying any tax due on that income.

Scenario 2 – individual with Hong Kong employment working outside Hong Kong

In this scenario, income earned by the digital nomad is prima facie subject to Hong Kong individual income tax. However, since part of the service is performed outside Hong Kong, the digital nomad may be eligible for certain tax exemptions or credits.

If the digital nomad has paid tax in a territory that does not have a double tax agreement with Hong Kong, for example Australia, that portion of their income may be exempt from Hong Kong individual income tax.

Conversely, for income derived in a territory that has a double tax agreement with Hong Kong, for example Canada or the UK, relief from double taxation is provided through a tax credit rather than an exemption.

Regardless of whether the income is taxable or exempt, both digital nomads and their employers are responsible for reporting the income to the Hong Kong tax authority, and digital nomads should ensure that any taxes due are paid.

Scenario 3 – director working outside Hong Kong

Unlike the taxability of employment income, which depends on the number of days worked and the location of the employment contract, the taxability of director’s fees generally follows the location of incorporation of the appointing company, irrespective of where the director resides, and no tax apportionment is allowed for the director’s fee.

Hence, for digital nomads receiving director’s fees from a Hong Kong incorporated company, irrespective of the number of days they stay in Hong Kong, the entire director’s fees should be subject to individual income tax in Hong Kong.

Similar to Scenario 2, relief from double taxation of the director’s fees may be available through certain tax exemptions or credits.

Visa requirements

Amidst the excitement of exploration lies a vital consideration that cannot be overlooked – visa requirements. Both employers and employees need to diligently assess whether a valid visa is necessary to work legally in their chosen destination. For example, a digital nomad may need a specific visa to work in Hong Kong, while a Hong Kong resident might require the appropriate visa to seek opportunities abroad. Neglecting visa regulations can lead to serious consequences for both the digital nomad and their employer.

Take, for instance, the case of Tsuguo Sakumoto, a Japanese individual who travelled to Hong Kong to participate in a cultural event on a tourist visa. The Hong Kong Immigration Department determined that, given the nature of the event, Mr Sakumoto had effectively engaged in employment without proper authorisation. Consequently, Mr Sakumoto faced arrest and deportation for breaching local immigration laws. This could be costly both from a monetary and a reputational perspective.

Navigating these complexities is crucial for anyone embracing the digital nomad lifestyle. By understanding and adhering to visa requirements, digital nomads can fully enjoy their adventures without the looming threat of legal repercussions.

Takeaways

As the digital nomad lifestyle continues to gain popularity, it is vital for both employers and employees to grasp their tax and legal obligations. Thoughtful planning and compliance are essential to sidestep potential pitfalls. While employers may have fewer responsibilities than employees, they should actively monitor the location of their employees, including the number of days in each location, and should support their team members in navigating these complexities to promote sound corporate governance. Consulting with tax professionals or legal advisers can further enhance compliance and provide a peace of mind.

Yvette Chan, Managing Director, Ansel Yip, Senior Director, Lucas Ting, Senior Manager, and Amanda Huang, Senior Associate

Alvarez & Marsal Tax