Preparing for Hong Kong’s new USM regime

The Institute’s 26th Annual Corporate and Regulatory Update (ACRU), held in hybrid mode on 6 June 2025, explored the most pertinent governance issues of today. In part one of this review, CGj examines Hong Kong’s upcoming regime for the uncertificated securities market (USM).

Highlights

- the USM regime marks a major enhancement of Hong Kong’s financial infrastructure, allowing legal title to be held and transferred electronically without the need for physical share certificates

- the USM regime is set to improve market efficiency while also enhancing investor protection, transparency and corporate governance

- regulatory bodies urge early action by issuers, share registrars and governance professionals to ensure a smooth transition

Now in its 26th year, ACRU continues to serve as a trusted platform for open dialogue among regulators, directors, senior executives and governance professionals. With over 2,300 participants attending in person and online, ACRU 2025 reflected the growing recognition that sound governance is not just good practice, but is a strategic imperative for maintaining Hong Kong’s market resilience and competitiveness.

From technical compliance reminders to broader reflections on sustainability, technology and capital market developments, this year’s forum offered both practical guidance and forward-looking insights for governance professionals navigating an increasingly complex regulatory landscape.

The USM regime

The implementation of the USM regime, scheduled to take effect in early 2026 – following the completion of relevant legislative processes and subject to market readiness – will elevate Hong Kong’s financial market infrastructure by further enhancing efficiency through streamlining and automating processes. In his ACRU presentation, Paul Malam, Head of Policy and Secretariat Services, Listing, Hong Kong Exchanges and Clearing Limited (HKEX), provided practical guidance on how the USM regime will be embedded in the Listing Rules.

Background and current position

Under the current regime, Hong Kong law requires paper instruments to evidence and transfer legal title to shares and certain other securities. Investors may hold these securities either as legal owners outside the Central Clearing and Settlement System (CCASS), in which case transfers must occur off-market, or as beneficial owners of securities held in CCASS, where legal title is vested in HKSCC Nominees Ltd, a wholly owned subsidiary of HKEX.

For practical reasons, the vast majority of investors today hold only beneficial interests in their securities through CCASS. Legal title remains with the CCASS nominee and even securities held electronically through CCASS ultimately trace back to physical share certificates lodged with the share registrar.

The USM regime introduces a legal and operational framework that allows the legal title to securities to be held and transferred in uncertificated form, entirely removing the need for physical share certificates. A key aim of the USM regime is to modernise market operations, reduce the risks associated with paper-based processes and enhance investor protection.

New structure and scope of USM

Mr Malam clarified that the USM regime introduces a new structure for holding securities without the need for paper documents. The two existing methods of holding securities – inside and outside CCASS – will remain in place, but with enhanced digital capabilities. Securities held outside CCASS will continue to carry legal title and may now be held electronically via a USM facility maintained by an approved securities registrar (ASR). These securities will remain available for off-market transfers only. Securities held within CCASS will continue to reflect only beneficial ownership, with legal title retained by HKSCC Nominees.

The dematerialisation of shares held outside CCASS will not be mandatory, Mr Malam added. Paper certificates will continue to evidence legal title, unless shareholders choose to deposit them into either their own USM facility outside CCASS or into CCASS, typically in preparation for an on-market transaction. Shares held within CCASS will be dematerialised once an issuer joins the USM regime, subject to the standard dematerialisation process stipulated in the legislation.

The scope of the regime covers a wide range of securities constituted under Hong Kong law, including shares, depository receipts, stapled securities, interests in collective investment schemes such as REITs that can be withdrawn from CCASS, subscription warrants and rights under a rights issue. The regime will apply to the securities of all listed and to-be-listed companies, with those incorporated in Hong Kong, the Chinese mainland, the Cayman Islands and Bermuda being subject to the five-year deadline for participation once the USM regime is implemented.

‘Depositing and withdrawing shares from CCASS should become significantly faster under the USM regime,’ Mr Malam explained. ‘At present, it can take 10 days or more due to the reliance on paper documentation. Under the new USM regime, this process should be reduced to not more than two days, and in many cases just intraday, as it will involve only the electronic crediting of securities into accounts.’

He also noted improvements in efficiency around corporate actions. ‘Book-close periods, where the register is frozen ahead of events such as general meetings or rights issues, should be much shorter, or, in some cases, eliminated altogether,’ he said. ‘Currently, registrars need time to process paper documentation to determine legal title on the record date. Under the new regime, with the shift to fully electronic records and mandatory record-keeping by ASRs, that manual processing will no longer be required.’

Benefits of USM

Yan Leung, Associate Director, Supervision of Markets, Securities and Futures Commission (SFC), highlighted the persistent reliance on paper certificates in Hong Kong’s securities market, noting that there are approximately 16 million physical certificates in the market, around five million of which are inside CCASS, with 11 million outside. ‘If we focus on CCASS operations, one might consider that our securities market is very efficient,’ she said. ‘However, the continued reliance on paperbased and manual processes creates operational constraints and limits the further development of a more efficient market.’

Ms Leung reiterated that the USM initiative will elevate Hong Kong’s financial market infrastructure by removing the burdens associated with paper certificates. ‘For investors who wish to hold shares in their own names, the new USM regime means they no longer have to worry about storing physical certificates, or the inconvenience and risks involved if those certificates are lost or damaged,’ she said. ‘It also means being able to enjoy both full shareholder rights and the convenience of managing and transferring securities electronically.’

Beyond investors, Ms Leung said the USM regime will bring benefits to issuers and other market participants as a step toward enhanced investor engagement and improved corporate governance. As a general rule, greater shareholder transparency leads to better communication between companies and investors. The USM regime will also promote straight-through processing and support greener markets, and will undoubtedly help elevate Hong Kong’s market infrastructure, reinforcing its competitiveness and position as an international financial centre.

Implementation timeline

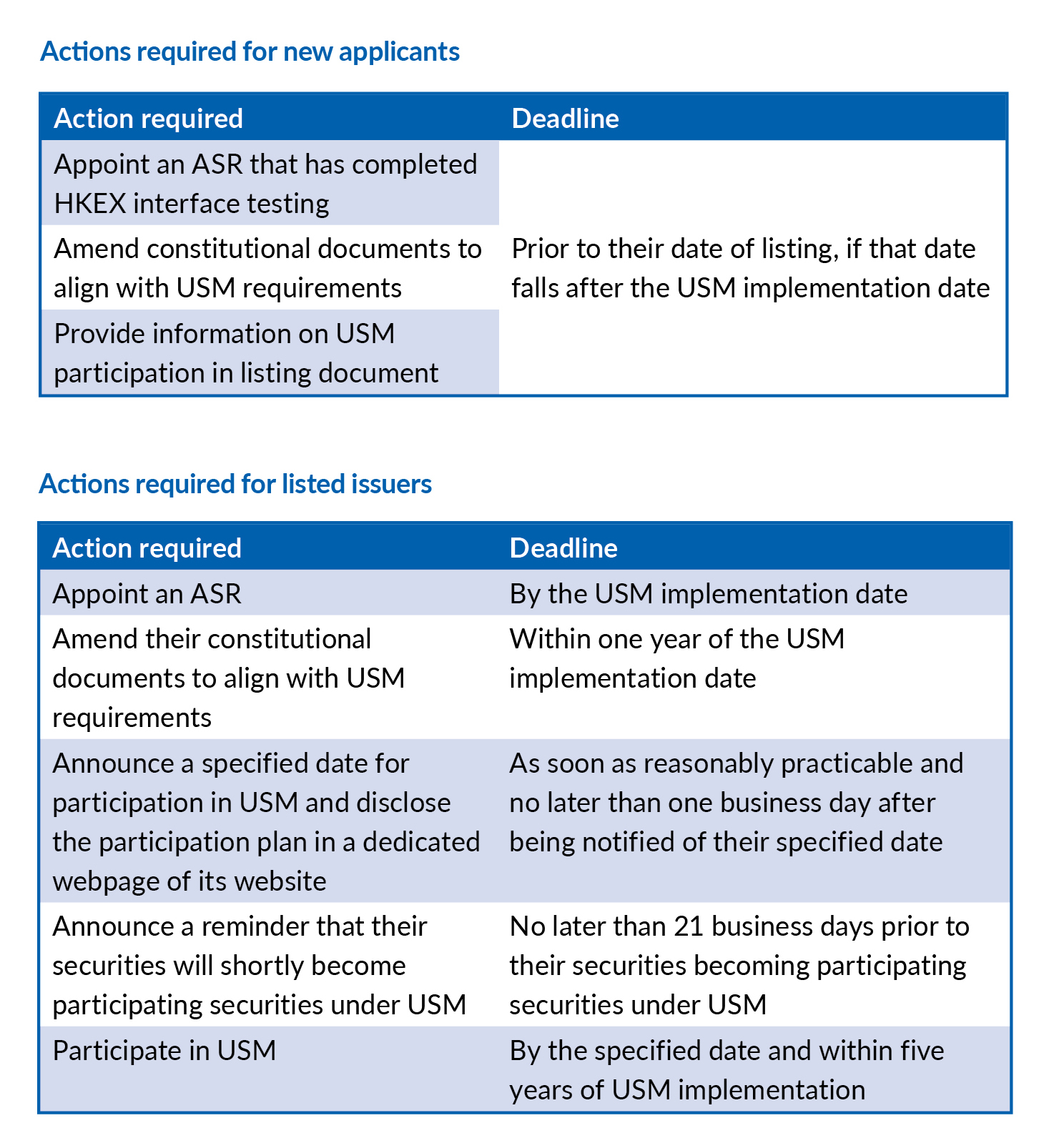

Thrity Mukadam, Senior Director, Supervision of Markets, SFC, noted that the entire market, covering over 2,500 listed issuers, is expected to transition to the USM system, beginning with issuers incorporated in four key jurisdictions – Hong Kong, the Chinese mainland, the Cayman Islands and Bermuda. Ms Mukadam prioritised the importance of early preparation and regulatory compliance. ‘We are already reviewing ASR applications, and we encourage issuers to start the process of engaging with their share registrars as soon as possible,’ she said.

The new statutory framework will impose requirements on share registrars around recordkeeping, third-party fund handling, communications with registered shareholders and maintaining adequate resources. There will also be clear handover procedures when an issuer switches registrars. ‘We are keen to ensure a smooth transition to the USM regime,’ she explained. ‘But we can’t guarantee that all existing share registrars will be approved – they must first meet the requirements and standards under the new regime before that can happen.’

Turning to implementation and cost concerns, Ms Mukadam acknowledged that both issuers and investors will bear some financial burden. Investors will face certain initial fees, including a facility setup charge and a fee for dematerialising certificates. However, she emphasised the long-term benefits. ‘Removing paper and manual processes should ultimately bring cost savings and greater efficiency in the long run,’ she said.

“Removing paper and manual processes should ultimately bring cost savings and greater efficiency in the long run.”

Thrity Mukadam

Senior Director, Supervision of Markets, Securities and Futures Commission

The Institute’s views on the USM regime

The USM regime represents a transformational shift in how securities are held, registered and managed in Hong Kong. For governance professionals, it brings both challenges and opportunities, from rethinking shareholder engagement to overhauling internal processes. While the transition may appear technical, its success hinges on human oversight, legal integrity and market-wide collaboration.

With regulatory clarity now emerging and a phased implementation plan in place, governance professionals would do well to begin preparations immediately. The Institute has actively engaged in the consultation process and has submitted detailed responses to the SFC and HKEX, and it welcomes the forthcoming USM regime as a timely and necessary enhancement effort that strengthens transparency and efficiency.

Two major themes the Institute has accentuated in these submissions, however, are the cost implications issuers and the eventual need to eliminate the parallel system of having both physical and electronic systems side by side – a system which in itself will create unnecessary costs for issuers.

In addition to the above, the Institute’s key recommendations include:

- Investor education: the Institute stresses the importance of educating retail investors, particularly regarding the different shareholding models they can choose from.

- Shareholder rights: the Institute recommends clear procedures to ensure that shareholders retain effective access to voting, dividend information and communications, regardless of holding type.

- Governance readiness: the Institute highlights the need for issuers to update internal procedures and to provide training to governance teams.

Navigating uncertainty through strengthened financial infrastructure

ACRU has been a trusted forum connecting regulators, directors, senior executives and governance professionals for a quarter of a century, but as David Simmonds FCG HKFCG, Institute President, and Chief Strategy, Sustainability and Governance Officer, CLP Holdings Ltd, pointed out in his Welcoming Address at this year’s ACRU, it is more than just a technical update. In addition to covering the latest corporate and regulatory developments in the market, ACRU also focuses on the implications of macro developments impacting Hong Kong.

In this context, ACRU 2025 included a wide-ranging interview with Joseph HL Chan JP, Under Secretary for Financial Services and the Treasury, the HKSAR Government, which addressed the bigger-picture issues of relevance to all market participants.

Conducting the interview, Gill Meller FCG HKFCG(PE), International Vice President and Institute Past President, and Legal and Governance Director, MTR Corporation Ltd, asked Mr Chan about the latest government policy initiatives to improve Hong Kong’s resilience at a time of global uncertainty in financial markets.

Mr Chan emphasised that Hong Kong has strong fundamentals that have helped it weather many of the crises of the past. Those include a transparent, rules-based regulatory system, free capital flow, legal certainty under the common law and a clear, low-tax regime. Moreover, he welcomed the fact that Hong Kong – despite the global volatility and external challenges – has seen a notable rebound.

The city ranked first globally in IPO fundraising in the first half of 2025, daily trading turnover has more than doubled year-on-year and it continues to lead Asia in international bond issuance. The insurance sector has also shown strength, with record levels of new business and a 7% increase in bank deposits in 2024, reflecting both market confidence and resilience.

Turning to the outlook for overseas and Chinese mainland companies, Ms Meller asked about secondary listings in Hong Kong. Mr Chan noted that over 70% of US-listed Chinese enterprises already have a secondary or dual listing in Hong Kong, where the government is actively engaging the remaining firms. While listing standards must be upheld, Mr Chan said that Hong Kong has been able to offer flexibility through mechanisms like confidential filings and dedicated teams to guide issuers through the process. ‘We may offer flexibility in timelines and processes, but we maintain the integrity of our market through our core requirements,’ he said.

On the topic of listing reform, Ms Meller asked how the government is addressing market efficiency and global competitiveness. Mr Chan explained that the authorities are pursuing multiple enhancements, including shortening the settlement cycle to T+1 (in other words, one working day after the transaction date), upgrading the trading system, expanding round-the-clock RMB trading and exploring tokenised securities. These initiatives are designed to further advance the infrastructure and to strengthen Hong Kong’s position as a gateway for both regional and global capital.

The conversation then shifted to green finance. Ms Meller asked about Hong Kong’s positioning in this space. Mr Chan described Hong Kong as Asia’s leading sustainable finance hub, connecting Chinese and international investors. He drew attention to the launch of a voluntary carbon trading platform that now hosts around 100 verified projects, and pointed to the city’s growing role in green bond issuance and fundraising for climate technology companies.

Ms Meller also asked how Hong Kong is aligning its sustainability disclosure standards with global frameworks. Mr Chan responded that the Financial Services and the Treasury Bureau is committed to implementing the International Sustainability Standards Board framework. He stressed that the pace of adoption would be pragmatic, ensuring that local issuers have sufficient time and capacity to comply. ‘We are adopting international best practices, but at a pace that’s manageable for local issuers,’ he said.