Do companies with more women on boards achieve better sustainability performance?

Dr Agnes KY Tai, Director of Great Glory Investment Corporation and Senior Advisor of iPartners Holdings Ltd, reviews the empirical evidence for the benefits of board gender diversity, including whether a higher female presence on boards influences climate action or contributes to better environmental, social and governance (ESG) outcomes.

Highlights

- single-gender boards in Hong Kong will no longer be possible from the end of 2024, but as of June this year, 16% of listed issuers have yet to comply with HKEX’s mandate, despite the evidence for the benefits of board gender diversity

- a study of Fortune 1500 companies since 1992 suggests that companies with one or more women on their boards are significantly more likely to have improved sustainability practices, while those with at least three female board members show better ESG performance

- evidence demonstrates that more cognitively diverse boards, with gender being a significant contributor, can potentially improve ESG performance, better integrate climate action into strategy and best practices, raise board effectiveness, increase resilience of the company and improve financial performance

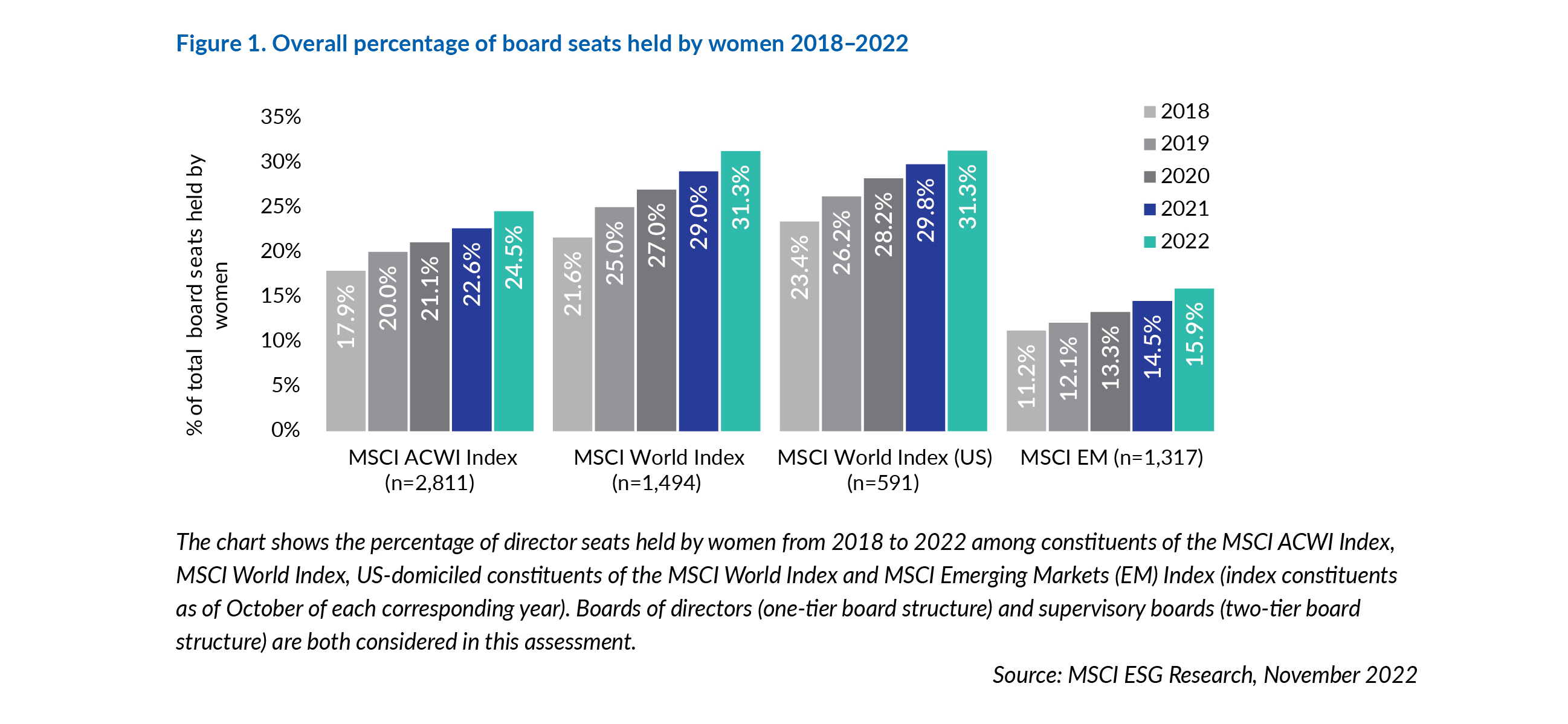

Although the overall percentage of board seats held by women has been on the increase (see Figure 1), regulators from developed to developing markets are still pushing for greater board diversity. In 2022, the European Union (EU) stipulated that women are to hold at least 40% of non-executive director positions, or 33% of total director positions (non-executive and executive), by 2026. In May 2022, the International Finance Corporation (IFC) reported that Kazakhstan was targeting a 25% representation of women in local joint-stock companies at the decision-making level by 2023. South Korea instructed all listed firms with 2 trillion Korean won or more in total assets to appoint at least one female director by the end of 2023.

In 2021, Hong Kong Exchanges and Clearing Limited(HKEX) mandated the end of single-gender boards after 31 December 2024. As of June 2024, at the half-way point of the year, 16% of the 2,624 listed issuers have yet to comply, while 19% of issuers have 30% or more female directors. Hang Seng Bank Ltd is the front-runner with 80% of board members being female.

Board gender diversity and firm performance

While gender is only one among several attributes that make up a cognitively diverse board, studies show a positive correlation between board gender diversity and financial performance in European companies.

A study of FTSE 100 firms in the UK found a positive and significant relationship between gender diversity and firm performance. Moreover, the results revealed that post-appointment financial performance is positively related to female age, level of education and where female board members also hold executive director positions.

In Asia, correlations between gender diversity and firm performance range from positive in Pakistan to neutral in India, while – in complete contrast – research demonstrates a significantly negative correlation in Japan. In terms of sector, a recent study of 444 firms from 2017 to 2020 across Asia shows that the presence of female board members has a positive effect on the financial performance of transportation and logistics companies at a certain level.

Board gender diversity and sustainability performance

But what about sustainability performance? Does a higher female presence on corporate boards influence climate action or result in better ESG outcomes?

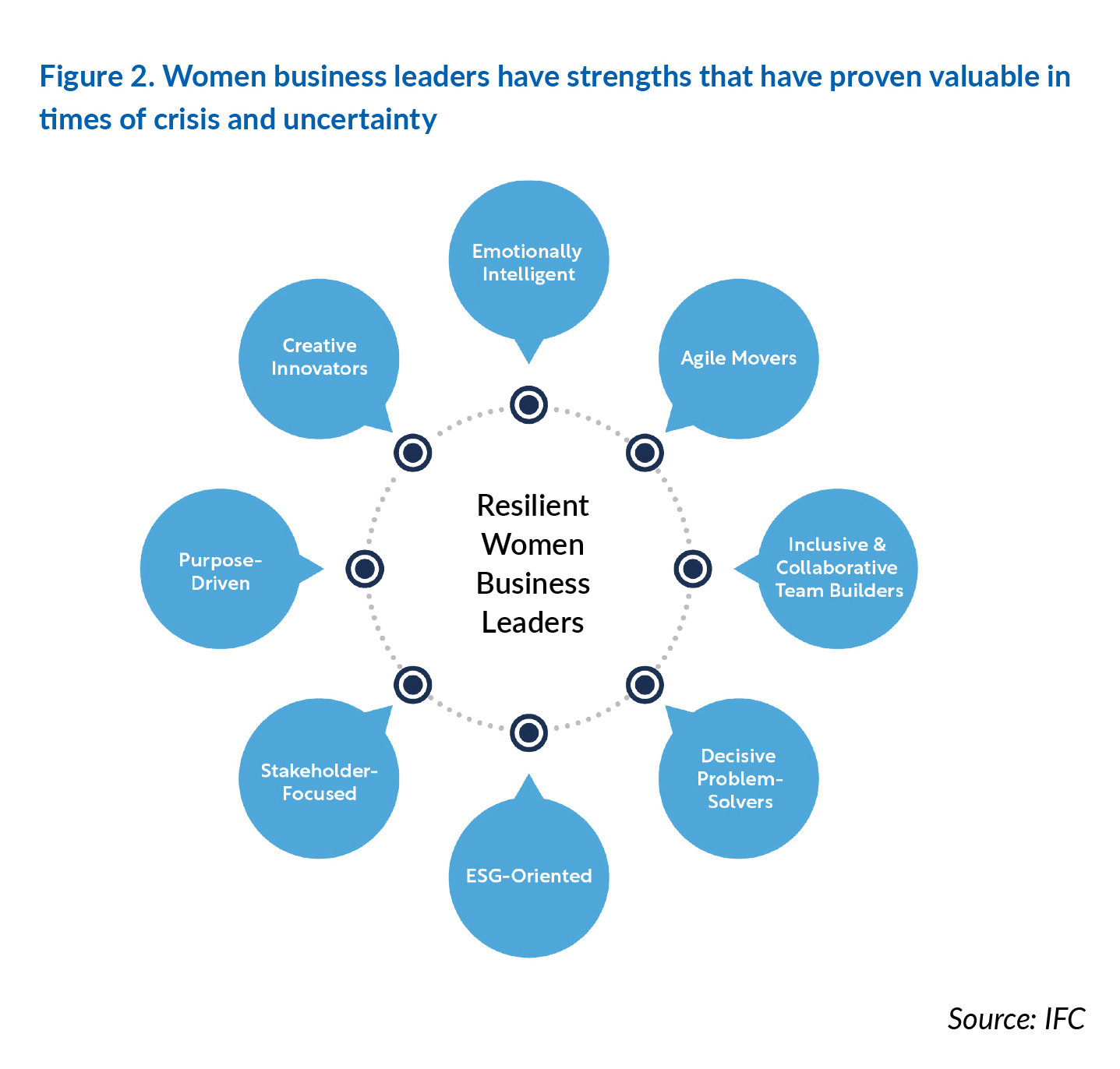

With Covid-19 only just behind us, many businesses are facing the complex uncertainties of climate change, geopolitical tensions, interest rate directions, deglobalisation, de-dollarisation, artificial intelligence (AI) and structural change in local economies, to name a few. According to the IFC, women have strengths that have proven valuable in times of crisis and uncertainty. This supports the argument for an increase in board competence when its structure is more diverse (see Figure 2).

BloombergNEF published a report in December 2020, titled Gender Diversity and Climate Innovation, the Executive Summary of which points out a number of interesting correlations (not causalities) and makes the following observations, among others:

- Early adopters of the recommendations of the Task Force on Climate-related Financial Disclosures show higher gender diversity and greater transparency on climate related data than peers.

- Leading integrated oil companies that have strategies for decarbonisation and digitalisation tend to have higher female board representation. Gender diversity in that sector, however, does not directly contribute to lowering emissions or expanding digitalisation.

- Increased and standardised disclosure of gender diversity will enable companies and financial markets to better assess the linkages between diversity and business performance. Data and benchmarks will also allow markets to backtest the relationships between the two.

Meanwhile, PwC’s 2021 Annual Corporate Directors Survey found that US female directors (87%) are far more likely to be concerned about the impact of climate change than their male colleagues (67%). A study published in 2022 by an asset management firm found that the most diverse 20% of the world’s 1,000 biggest companies across the UK, Italy, the US, France, Japan, Germany and Scandinavia were more aligned with a goal of capping global warming at 1.5°C above the pre-industrial average by 2050.

The World Bank Gender Strategy 2024–2030, which promotes increasing women’s representation in business leadership, has published a series of thematic policy notes. One of the 2023 publications states that: ‘Having more women in leadership is positively correlated with higher ESG standards, leading to improved business performance and inclusive economic growth.’

It is perhaps not surprising that an empirical study published in February 2024 that used the Morgan Stanley Capital International (MSCI) benchmark indexes to conduct their analysis, specifically the MSCI Index and the MSCI Emerging Market Index from 2010 to 2019, concludes that the proportion of female members on a company’s board of directors is negatively correlated with CO2 emissions. In addition, results indicated a negative correlation between board cultural diversity and CO2 emissions. However, the authors also warn that diversity may lead to internal conflicts within a company, resulting in agency costs and information asymmetry.

An article by the European Investment Bank (EIB) published in March 2023 provided several positive notes supporting more women on private sector boards. A 2023 report from the European Investment Fund shows that women-led firms have higher ESG scores than other companies. Furthermore, businesses with more women in leadership positions have better track records of adopting environmentally friendly practices, for example, investment in renewable energy. Women-owned businesses are more likely to pursue greater energy efficiency and practices, and banks run by women lend less to big polluters.

a 2023 report from the European Investment Fund shows that women-led firms have higher ESG scores than other companies

Cited in the EIB article is a study using S&P 1500 indexed firms in the United States from 2004 to 2016, which finds a positive relationship between female directors and sustainable investment, while female independent directors have a stronger impact on sustainable investment than male executive directors. In another study that covered Fortune 1500 companies since 1992, companies with one or more women on their boards were found to be significantly more likely to have improved sustainability practices. Companies with at least three female board members were shown to have a better ESG performance.

women-owned businesses are more likely to pursue greater energy efficiency and practices, and banks run by women lend less to big polluters

However, a number of studies published in 2023 and 2024 on women on boards in relation to ESG disclosures in Malaysian and Indonesian companies have mixed findings:

- in Malaysian and Indonesian manufacturing companies, women on boards are deemed beneficial

- in Indonesian companies, gender diversity is not a significant factor, and

- in Malaysian companies, board diversity (especially gender) is significant in fostering transparency, adherence to ethical standards and overall organisational effectiveness.

China and Hong Kong

A 2023 paper examines Chinese listed companies from 2010 to 2020 and concludes that the higher the proportion of female directors on the board, the higher the corporate ESG practice score, with non-state-owned enterprises indicating greater positivity. Since the ESG assessment mechanism was not prevalent or robust during the study period, the results require further verification using more recent data. The reverse cause–effect argument should also be considered – private firms can have more flexibility in directors’ appointments and the founders may favour board diversity more, resulting in those firms having brought more women into the boardroom.

Nonetheless, outcomes from around the world provide encouraging evidence that more cognitively diverse boards – gender being a significant contributor – can potentially improve ESG performance, better integrate climate action into strategy and best practices, raise board effectiveness, increase resilience of the company and be conducive to desirable financial performance.

Hong Kong listed companies that have yet to comply with the no single-gender board rule would do well to accelerate the appointment of at least one female director who possesses the attributes and competencies that help the business navigate through complex uncertainties – be that climate risks and opportunities, the impact of AI, trade sanctions or more stringent regulations imposed by the jurisdictions of their customers. There is no time to lose.

Hong Kong listed companies that have yet to comply with the no single-gender board rule would do well to accelerate the appointment of at least one female director who possesses the attributes and competencies that help the business navigate through complex uncertainties

Dr Agnes KY Tai PhD CCB.D SCR®, ESG Investing, Responsible AI, FRM CAIA MBA FHKIoD

Director of Great Glory Investment Corporation and Senior Advisor of iPartners Holdings Ltd

Previous CGj articles by Dr Tai are available on the journal website: https://cgj.hkcgi.org.hk.