Ellie Pang FCG HKFCG(PE), Institute Chief Executive, highlights the major changes ongoing in Hong Kong’s regulatory requirements relating to ESG and climate-related disclosures.

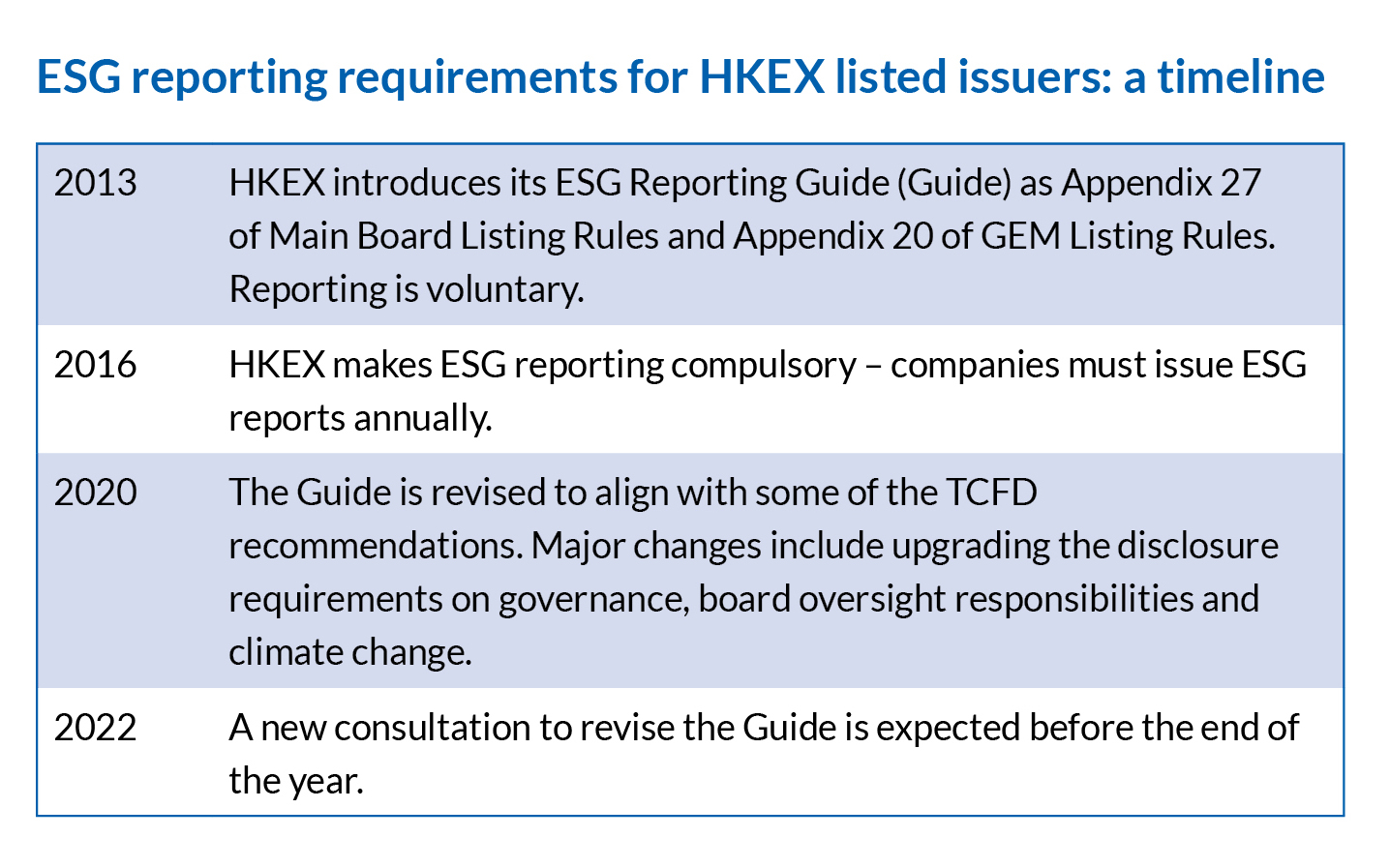

ESG and climate change-related issues have become an unavoidable risk and responsibility for companies today, and regulatory policies are continuing to tighten. At the Annual Corporate Regulatory Update (ACRU) held by the Institute in June 2022, representatives of Hong Kong’s major regulators shared that tougher disclosure requirements relating to ESG and climate change are expected soon. In particular, the Listing Rules will be upgraded to close the gap with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD) and the new standards soon to be finalised by the International Sustainability Standards Board (ISSB) – see ‘The convergence of reporting standards’ below for more on the TCFD and ISSB reporting standards.

In addition, Hong Kong Exchanges and Clearing Ltd (HKEX) is consulting industry practitioners on various proposals and will soon publish a consultation on revising its ESG Reporting Guide (Guide). Tougher disclosures on scenario analysis, greenhouse gas (GHG) emissions and more specific metrics on climate-related risks are expected.

Stepping up efforts to address the challenges

Recognising that ESG and climate change are some of the most pressing issues of our time, the Institute has intensified its efforts in bringing the most up-to-date information, guidance, thought leadership and training to its members, students and the wider governance community.

Leveraging the expertise and experience of the Institute’s members and their networks in this area, and collaborating and partnering with professional firms, ESG experts, practitioners and academics, the Institute has organised numerous ESG-related CPD events.

In 2022 alone, noteworthy events include the Climate Change Conference held in January, a webinar on this theme (Climate Change Reporting – Changes Are Coming Quickly) in May, and the ESG and climate change session of the Institute’s 13th Biennial Corporate Governance Conference held in September 2022.

The Institute also published on its website a series of five ESG interviews with governance professionals and heads of ESG in Hong Kong-listed companies from June to August 2022 that examined the best practices, challenges and opportunities in key industry sectors for which supplemental guidance was given by the TCFD. The interviews gave an insight into how companies in various sectors can tackle ESG and climate change issues.

In addition to the above, the Institute, jointly with KPMG and CLP, published a thought leadership report, Climate Change Reporting: Imminent, Challenging & Mandatory – The Opening Moves, in July 2022.

The convergence of reporting standards

In addition to HKEX’s Guide, many companies adopt, or fully/partially comply with, international reporting standards in their ESG reporting so as to meet the needs and demands of multiple stakeholders, including investors.

GRI

The Global Reporting Initiative (GRI) has produced the most well-known and widely adopted set of reporting standards. Reporting based on the GRI Standards provides information about an organisation’s positive or negative contributions to sustainable development. The earliest versions of HKEX’s Guide were modelled on the GRI Standards in force at the relevant time, with modifications to suit local markets. The Guide was intended to be used as an easier first step for issuers to report on ESG. It was made clear in the Guide itself that it was not comprehensive, issuers who were competent to do so could use international standards for their reporting. That includes the GRI Standards and other similar standards such as the Integrated Reporting Framework, ISO 26000 and CDP.

TCFD

The TCFD was established by the Financial Stability Board, a body of G20 finance ministers and central bank governors with the remit to develop recommendations on the types of information that companies should disclose to ensure that investors, lenders and insurance companies are able to make informed decisions. In doing so, it also aims to tackle climate change, help companies to manage risks and opportunities associated with climate change, and facilitate the transition to a sustainable, low-carbon economy.

Published in 2017, the TCFD Recommendations on Climate-Related Financial Disclosures (TCFD recommendations) comprise four main themes:

- governance

- strategy

- risk management, and

- metrics and targets.

These thematic areas are interrelated and supported by 11 recommended disclosures aimed at providing information that would help stakeholders understand how reporting entities assess climate-related risks and opportunities. The recommendations are widely supported by governments and regulators around the world, including Hong Kong, and HKEX’s Guide was amended in 2020 to align with the TCFD approach.

ISSB

In November 2021, the International Financial Reporting Standards Foundation (IFRS) established the ISSB to create a more consistent and comparable baseline of investor-focused sustainability standards. In March 2022, the ISSB published two draft Sustainability Disclosure Standards: IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information; and IFRS S2 Climate-related Disclosures (together the ‘Draft ISSB Standards’). The Draft ISSB Standards are expected to be finalised and released at the end of 2022.

The Draft ISSB Standards build on the TCFD recommendations and incorporate industry-based requirements designed to help companies disclose information to investors and other stakeholders. The reporting items are also conducive to reducing the scope for greenwashing. There was therefore much thought and work from ISSB under the 600-page long document covering over 60 plus industries.

The Institute made a submission on the Draft ISSB Standards in July 2022 (available on the Institute’s website: www.hkcgi.org.hk).

Current ESG reporting requirements

The most significant changes to the Listing Rules on ESG reporting in 2020 were the alignment of the Guide with the TCFD recommendations. This article will examine the disclosures under the four themes of the TCFD recommendations, referencing the relevant provisions of the Guide.

1. Governance

Since 2020, it has been mandatory for directors to disclose their leadership role in ESG strategy and reporting, including but not limited to assessing ESG risks and opportunities. Boards are also accountable for ESG issues and reporting.

The Guide requires ESG reports to contain a statement from the board setting out its consideration of ESG issues. Under the Corporate Governance Code, the board has the ultimate responsibility to assess the risks and opportunities that may arise in achieving the company’s objectives. ESG and climate-related risks are now some of the most real and pressing risks presented to businesses and should therefore be the board’s responsibility.

For example, if one of the company’s business objectives is to set up an operation in a location where it would depend on natural resources, such as water, any change in the availability, quality and cost of water may expose the company’s operation to risk, including government regulation, impact on the local community, as well as possible reputational damage resulting in lower ESG rating. A company’s ESG performance and ratings are under increasing scrutiny of investors and lenders. However, if the potential risks were anticipated at board level, and effectively eliminated or mitigated to an acceptable level, it would present the company with a business opportunity.

Given the importance of ESG performance and reporting, both to the sustainability of the company and the wider community, it is not surprising that regulators and other stakeholders demand ESG issues to be considered at the top of the board’s agenda. The board is responsible and accountable for the company’s failures in ESG performance and reporting. Boards that delegate ESG performance and reporting to junior members or contract out to third parties without senior management involvement might find themselves in breach of directors’ duties and the Listing Rules.

2. Strategy

The TCFD calls for the integration of climate-related issues into a company’s strategy, identifying and disclosing the potential impacts of climate-related risks and opportunities on the company’s businesses, strategy and financial planning. Such disclosures would improve the company’s risk management and long-term sustainability, with the added advantage of engendering investor and lender confidence in the company, improving the company’s access to capital. The Guide states, at paragraph 10, that the board is responsible for the overall ESG strategy of the company.

3. Risk Management

The TCFD calls on companies to disclose the processes that they use to identify and assess climate-related risks and to report on how these risks are managed. These disclosure requirements have been built into paragraph 13 of the Guide.

4. Metrics and Targets

The TCFD Recommendations require disclosure of the metrics used by companies to assess and manage climate-related risks and opportunities in line with their strategy and risk management systems. Since July 2020, HKEX listed companies need to disclose, on a ‘comply or explain’ basis, certain key performance indicators (KPIs) on climate change related policies, metrics and targets in their ESG reports.

Prepare for the new rules

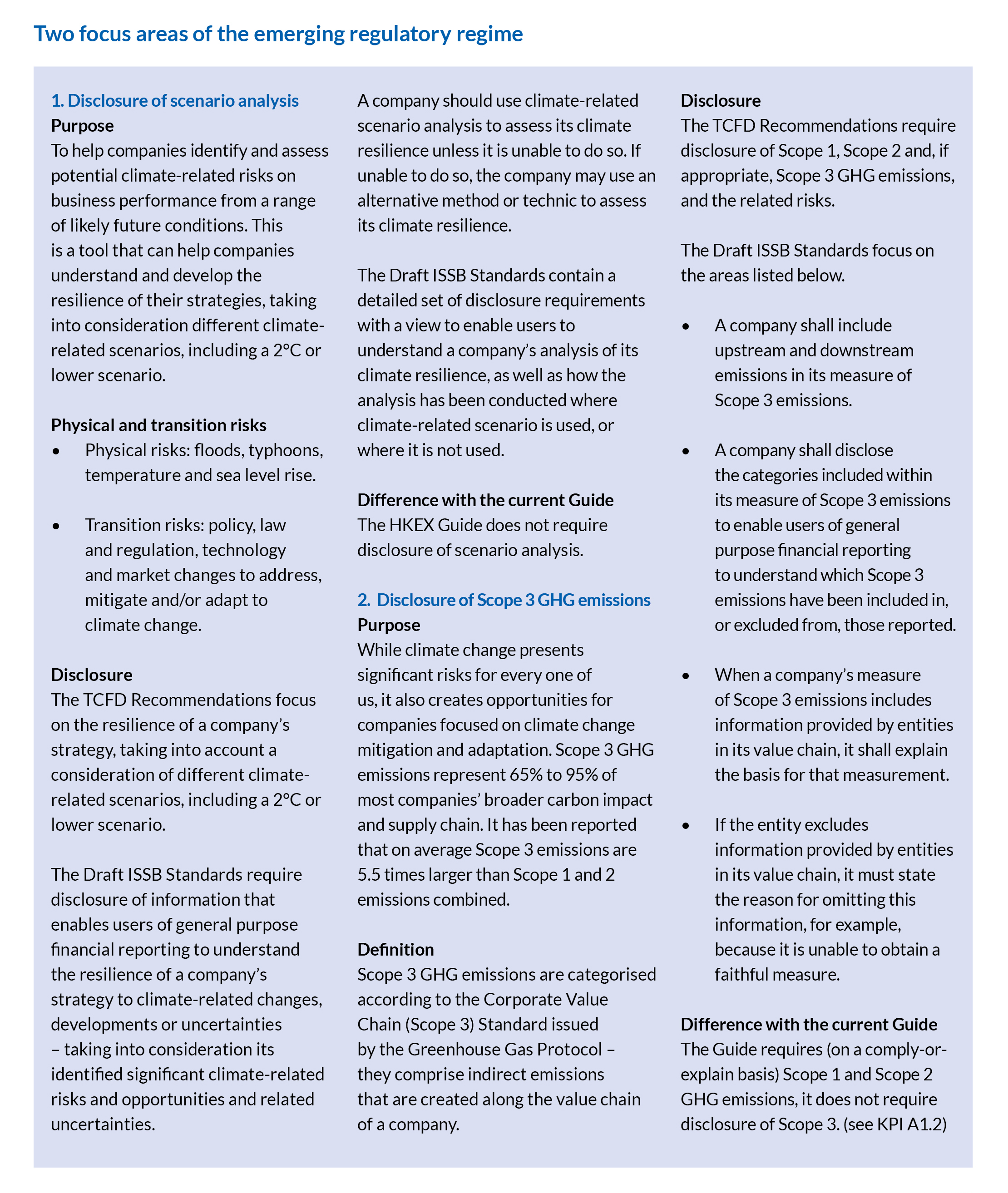

As indicated in ACRU, regulators in Hong Kong are working towards closing the gap between the local reporting requirements and those of the TCFD and ISSB. Two areas – the disclosure of companies’ use of scenario analysis and of their Scope 3 GHG emissions – require a closer examination so as to be better prepared for the new rules (see ‘Two focus areas of the emerging regulatory regime’).

Governance professionals and company secretaries need to stay ahead of the curve, and be prepared for the inevitable new challenges on ESG and climate reporting. The Institute is committed to helping our members and students to work towards better ESG and climate reporting. Please write to us if you have any feedback or request that would help us to better serve you.

Ellie Pang FCG HKFCG(PE)

Chief Executive, The Hong Kong Chartered Governance Institute

The Institute’s publications mentioned in this article are available at the Institute’s website: www.hkcgi.org.hk.

ESG报告将迎来哪些新变化?

公会总裁彭京玲女士FCG HKFCG(PE)就香港对ESG和气候相关披露之规定,重点剖析即将迎来的重大变化。

近年來,ESG和气候变化相关问题已成为当今企业不可回避的风险和责任,而规管政策亦正持续收紧。公会于 2022年6月召开的“企业规管最新发展研讨会”(ACRU),参会香港监管机构代表指出,与 ESG 和气候变化相关的披露要求将更趋于严格,特别是《上市规则》将拉近“气候相关财务信息披露工作组”(TCFD)建议及“国际可持续发展准则理事会”(ISSB)即将定稿的新准则之间的差距。关于TCFD和ISSB报告标准的更多信息,见下文 “报告标准之趋同”。

此外,香港交易所(港交所)正就各项提案咨询业界人士,预计很快会就修订《ESG 报告指引》(指引)发布咨询文件,并将会对情景分析、温室气体排放以及更多气候相关风险指标,要求更严格的披露 。

加大力度应对挑战

ESG和气候变化已成为当下最为紧迫的问题。有鉴于此,公会已加紧努力务求为会员、学员以至治理业界,提供最新的信息、指引、思想引领及培训。

公会利用会员及会员网络的专业知识和经验,与专业机构、ESG专家、治理专业人士和学术界密切合作,举办了众多ESG相关的CPD活动。

仅在2022年,公会已举办了一系列重点活动,包括1月召开“气候变化研讨会”、5月的“气候变化报告:变化在即”网络研讨会,以及9月“第13届公司治理研讨会”(两年一度)期间举办ESG和气候变化专题讨论。

另外,公会于今年6月至8月期间,对香港上市公司的公司治理专业人士和ESG负责人,进行了五次ESG访谈并刊载于公会的网站上, 就TCFD的补充指引,探讨主要行业的最佳实践、挑战和机遇,深入了解这些行业的公司如何处理ESG和气候变化的议题。 除上述外,公会于今年7月联合毕马威与中电控股,发布了《气候变化报告:如何就这项迫在眉睫、充满挑战的任务做出部署》报告。

报告标准之趋同

除港交所的《指引》外,许多公司还在ESG报告中,采用或完全/部分遵守国际报告准则,以满足投资者和其他利益相关者的需求。

GRI

“全球报告倡议组织”(GRI)是知名度最高、应用最广的准则。根据GRI准则进行报告,能夠反映企业在可持续发展方面,产生的正面和负面影响。最早版本的港交所《指引》,以当时的GRI为蓝本,经适当修改以适应本地市场。由于《指引》旨在帮助企业做好ESG报告的起步工作,所以已明确指出其本身尚不够全面,有能力的发行人应遵照国际准则进行报告。这包括GRI及其他類似准则,如《综合报告框架》、ISO 26000和CDP。

TCFD

TCFD由“金融稳定委员会”设立,该委员会由20国集团财长和央行行长组成,其职责就公司应披露的信息类型提出建议,以确保投资者、贷款人和保险公司能够作出知情的决策。同时,在应对气候变化方面,帮助公司管理与气候变化相关的风险和机遇,促进向可持续的低碳经济转型。 2017年,TCFD发布了“气候相关财务信息披露的建议”(TCFD建议),涵盖四个主题领域:

- 治理

- 战略

- 风险管理

- 指标和目标

这些主题领域相互关联,并从11个方面提出了披露建议和信息,以帮助利益相关者了解报告的评估系统与气候相关的风险和机遇。香港及世界各地政府与监管机构对此普遍给予支持,港交所于 2020 年修订了《指引》,以与 TCFD建议接轨。

ISSB

2021年11月,“国际财务报告准则基金会”(IFRS)成立了ISSB,制定以投资者为中心的可持续发展准则,建立更一致和可比较的基准。2022年3月,ISSB公布了两项可持续发展披露准则草案:《IFRS S1:可持续发展相关财务信息披露的一般要求》以及《IFRS S2:气候相关信息披露》(合称“ISSB准则草案”),并预计将于2022年底定稿并发布。

ISSB准则草案以TCFD建议为基础,纳入行业要求,帮助公司向投资者和其他利益相关者披露信息;而这些报告项目也有利于挤压“漂绿”的空间。在这份长达600多页的文件中,ISSB进行了大量的思考和工作,涉及60多个行业。

公会已于2022年7月针对ISSB准则草案提交了意见书(可在公会网站上查阅:www.hkcgi.org.hk)。

现行ESG报告要求

2020年,《上市规则》中关于ESG报告的最主要变化是《指引》与TCFD建议趋于一致。本文将参照《指引》的相关条文,对TCFD建议中的四个主题逐一进行研究。

1. 治理

自2020年起,董事会必须披露其在ESG战略和报告中的领导作用,包括但不限于评估ESG风险和机遇。董事会还要对ESG问题和报告负责。 《

指引》要求ESG报告须包含一份董事会声明,阐明董事会对ESG问题的考虑。根据《企业管治守则》,董事会对于评估在实现公司目标过程中,可能出现的风险和机遇负有最终责任。当前,ESG和气候相关风险是公司面临的最真切、最紧迫的风险之一,因此董事会责无旁贷。

举例来说,如果公司的业务目标之一是在某个依赖自然资源(例如水资源)的地方开展运营,那么水的可用性、水质和成本一旦有变,就可能使公司运营面临风险,包括政府监管、对当地社区的影响,以及可能的声誉受损,从而导致ESG评级降低。公司的ESG绩效和评级日益受到投资者和贷款人的关注。因此,如果董事会能够预见潜在风险,有效消除风险或将风险缓解至可接受的水平,就可以为公司带来商机。

鉴于ESG绩效和报告对公司乃至广大社区的可持续发展至关重要,监管机构及其他利益相关者都会要求企业将ESG问题摆在董事会议程的首要位置,而董事会须对ESG绩效和报告的失误负责。如果董事会将ESG表现和报告职责下放给资历较浅的员工,或者外包给第三方,而高级管理层却置身事外,则可能构成违反董事职责和《上市规则》。

2. 战略

TCFD呼吁将气候相关问题纳入公司战略,并在公司业务、战略和财务规划层面,识别和披露气候相关风险及机遇之潜在影响。这种披露将改善公司的风险管理,提高长期可持续性,并树立投资者和贷款人对公司的信心,让公司更容易获得资本的青睐。 《指引》第10段指出,董事会需对公司的整体ESG战略负责。

3. 风险管理

TCFD重点呼吁公司披露用来识别和评估气候相关风险的程序,以及报告如何管理这些风险。这些披露要求已被纳入《指引》的第 13 段。

4. 指标和目标

TCFD建议要求披露公司用于评估及管理气候相关风险和机遇的指标,这些指标应与公司的战略和风险管理系统保持一致。自2020年7月起,港交所上市公司需要按照“不遵守就解释”原则,在ESG报告中就气候变化相关的政策、指标和目标披露特定的关键绩效指标(KPI)。

为迎接新规作准备

正如ACRU指出,监管机构正在努力拉近港交所规定与TCFD和ISSB准则之间的差距。为了做好迎接新规的准备,需要密切关注情景分析和范围三之温室气体排放,这两个方面的信息披露(见“两大新规重点领域”) 。

ESG和气候报告方面的新挑战势难避免,公司治理专业人士和公司秘书们需要先人一步,未雨绸缪。公会将致力帮助会员和学员做好ESG和气候报告工作。如有任何反馈或要求,请致函公会,我们将竭诚为您提供服务。

彭京玲女士FCG HKFCG(PE)

香港公司治理公会总裁

本文所提及的公会出版物可在公会网站上查阅(www.hkcgi.org.hk)。