Carbon trading in China: relaunch of the certified emission reduction scheme

In the first of this two-part article, Terry Yang, Partner, Jane Chen, Senior Associate, and Kirsty Souter, Senior Associate, Clifford Chance, provide a practical overview of the mandatory and voluntary carbon markets in China, and clearly explain the relevant regulatory frameworks.

Highlights

- the recently relaunched emission reduction scheme is a milestone step in establishing the voluntary carbon market in China and is similar to other internationally recognised voluntary standards

- this development also impacts China’s national Emissions Trading System (ETS), which is its mandatory carbon market, and will provide key emitters with additional methods to offset their carbon emissions

- the regional carbon emission exchanges will now be required to upgrade their rules to align with the ETS Regulations

On 22 January 2024, the People’s Republic of China (PRC, China) officially relaunched the China Certified Emission Reduction (CCER) scheme, which is a milestone step in establishing the voluntary carbon market in China (the National CCER Scheme). The framework of the voluntary standard applicable under this scheme is similar to other internationally recognised voluntary standards (such as Verra and Gold Standard), whilst the implementation details are subject to PRC-specific regulatory requirements.

This development is critical as it also impacts China’s national Emissions Trading System (ETS) (the National ETS Market), which is the mandatory carbon market in China. This is because the key emitters under the National ETS Market are allowed to surrender (a) their acquired CCERs, together with (b) their allocated or acquired certified emission allowance for their actual carbon emissions under the National ETS Market, so the launch of the National CCER Scheme will provide key emitters with additional methods to offset their carbon emissions.

This first part of this article provides an overview of the mandatory and voluntary carbon markets in China, with a focus on the regulatory framework in relation to the National CCER Scheme. In part two, we will discuss the challenges for international investors in navigating the China carbon market access schemes and the key considerations when structuring carbon trades that have a PRC nexus.

Overview of the carbon market in China

Evolution of the mandatory carbon market

In 2011, China began to launch carbon emissions trading through pilot schemes in regional markets (see: Regional markets). Over the years, various regional carbon emission exchanges have been established to facilitate regional carbon trading activities. Cross-market trading between regions at the time was not feasible – the covered industries and the covered products of each exchange were tailored to reflect regional practice where applicable (that is, local versions of certified emission allowances (CEAs) and CCERs were traded on the regional market) and varied from each other.

The preparatory work to establish the National ETS Market (that is, the mandatory carbon market) started in 2017 and the National ETS Market was formally launched in 2021. Shanghai Environment and Energy Exchange was designated as the trading venue of the National ETS Market, whilst Hubei Emission Exchange was designated as the registrar of CEAs (in 2021, China Carbon Emissions Registration and Clearing Co Ltd was incorporated in Hubei, which now acts as the registrar for the National ETS Market).

In February 2024, China’s State Council issued the first State Council–level legislation in respect of the National ETS Market, the Interim Administrative Regulations on Carbon Emission Trading (2024) (the ETS Regulations), effective from 1 May 2024. Until then, the regional markets and the National ETS Market operated in parallel. However, the regional markets are now required to upgrade their rules to align with the ETS Regulations, and where products are tradable in the National ETS Market, the key emitters (as defined below) will no longer be permitted to trade the same product in the regional markets. Other market participants may still trade the same product in the regional markets.

Under the ETS Regulations, key emitters in designated sectors in China (the Key Emitters) – such as power generation, iron and steel, non-ferrous metals, chemicals, petrochemicals, construction materials, paper and aviation – are required to manage their actual carbon emissions to fall within the aggregate of (a) the annual CEAs allocated to them as notified by regulators (the CEA Quota), (b) the CEAs acquired from external parties (where applicable) and (c) the CCERs acquired from external parties (where applicable).

As a result:

- if a Key Emitter’s actual carbon emissions exceed the allocated CEA Quota (the Exceeding Portion), it may acquire (i) CEAs that correspond to the Exceeding Portion and/or (ii) CCERs to offset a small portion of the carbon emissions to fulfil its compliance obligations, and

- if a Key Emitter’s actual carbon emissions are less than the allocated CEA Quota (the Surplus Portion), it may sell the CEAs that correspond to the Surplus Portion for profit, or reserve such Surplus Portion for fulfilling its compliance obligations in the following year.

The list of the Key Emitters and the CEA Quota allocated to each Key Emitter is refreshed on an annual basis by provincial regulators.

Regional markets

Beijing: China Beijing Green Exchange

Shanghai: Shanghai Environment and Energy Exchange

Tianjin: Tianjin Climate Exchange

Chongqing: Chongqing Carbon Emissions Trading Center

Hubei: Hubei Carbon Emission Exchange

Guangdong: Guangzhou Emission Exchange

Shenzhen: Shenzhen Emission Exchange

Sichuan: Sichuan United Environment Exchange

Fujian: Haixia Equity Exchange

Evolution of the voluntary carbon market

The voluntary carbon credit market was first introduced in 2012 but has been less active in recent years, primarily due to a lack of tradable CCERs, given that China ceased to approve projects that can generate CCERs in 2017. More recently, China has been mobilising resources nationwide to achieve its peak carbon emissions and carbon neutrality goals. As a result, on 19 October 2023, the long-awaited Administrative Measures on Voluntary Greenhouse Gas Emission Reduction Transaction (Trial Implementation) (2023) (the CCER Measures) were issued, which relaunched the framework of the National CCER Scheme. The China Beijing Green Exchange has been designated as the trading venue under the National CCER Scheme. The National Center for Climate Change Strategy and International Cooperation, an institution subordinated to the Ministry of Ecology and Environment, was designated as the registrar under the National CCER Scheme (the CCER Registry).

China has been mobilising resources nationwide to achieve its peak carbon emissions and carbon neutrality goals

Interaction between mandatory and voluntary carbon markets

As elaborated above, the option for CCERs to be used to satisfy compliance obligations under the National ETS Market creates a significant link between the voluntary carbon market and the mandatory carbon market in the PRC, with the result that the demand for CCERs is likely to be enhanced by the participation of Key Emitters.

Notably, unlike the mandatory carbon market whereby the generation and allocation of the CEAs are government-led and will be subject to an annual cap at the nationwide level, the voluntary carbon market provides the possibility for investors to participate in the development of emission reduction projects while trading the generated CCERs at the same time. The volume of tradable CCERs depends on the number of registered CCERs generated from the relevant projects, as opposed to being subject to a cap set out by the regulators.

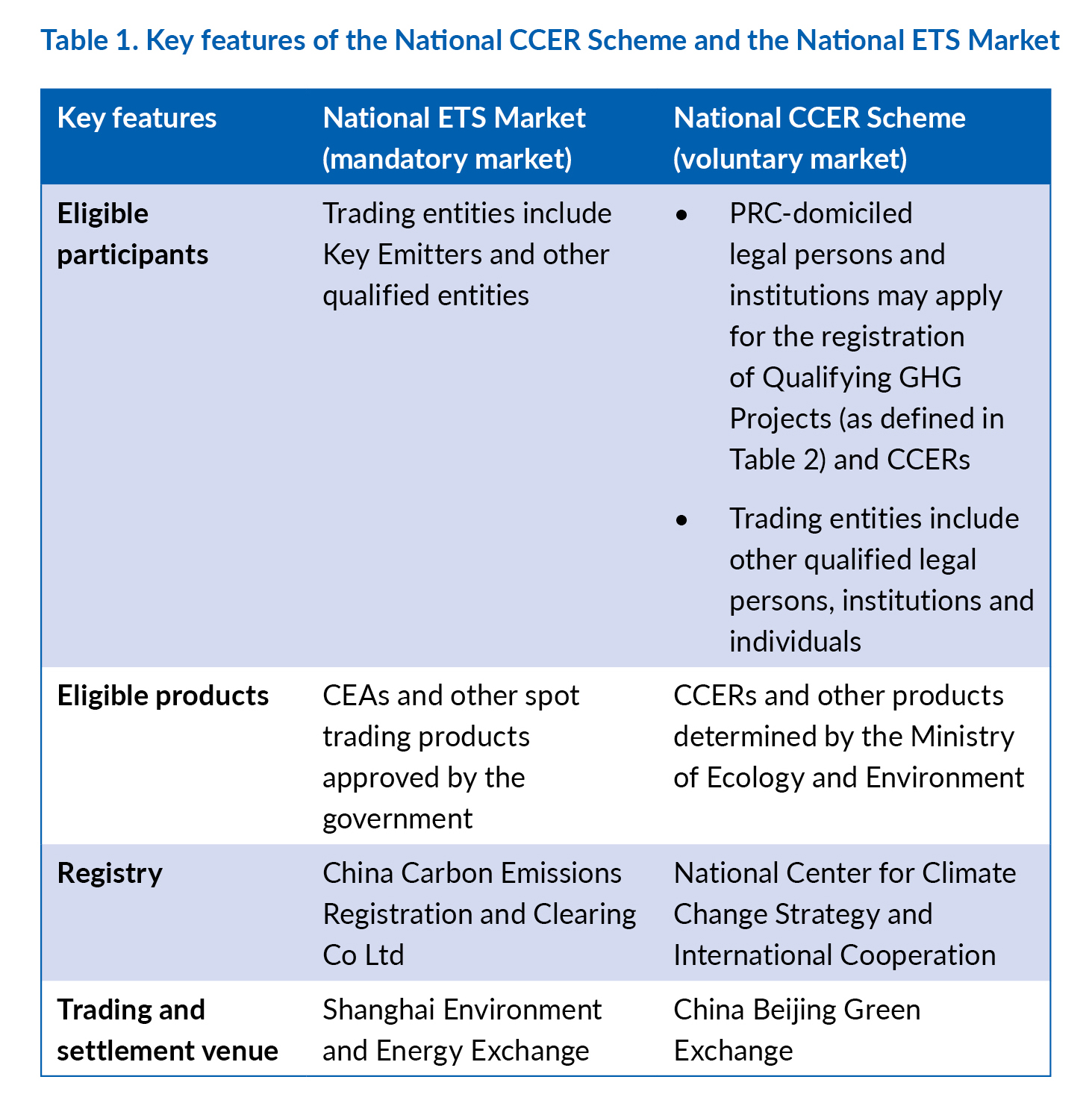

Key features of the National CCER Scheme and the National ETS Market

It should be noted that the National ETS Market and the National CCER Scheme are not underpinned by PRC statute. Instead, the evolving legal and regulatory landscape of carbon trading in China has been progressively developed by various administrative regulations and measures issued by competent regulators from time to time.

Table 1 summarises the key features of the National CCER Scheme and the National ETS Market.

the evolving legal and regulatory landscape of carbon trading in China has been progressively developed by various administrative regulations and measures issued by competent regulators

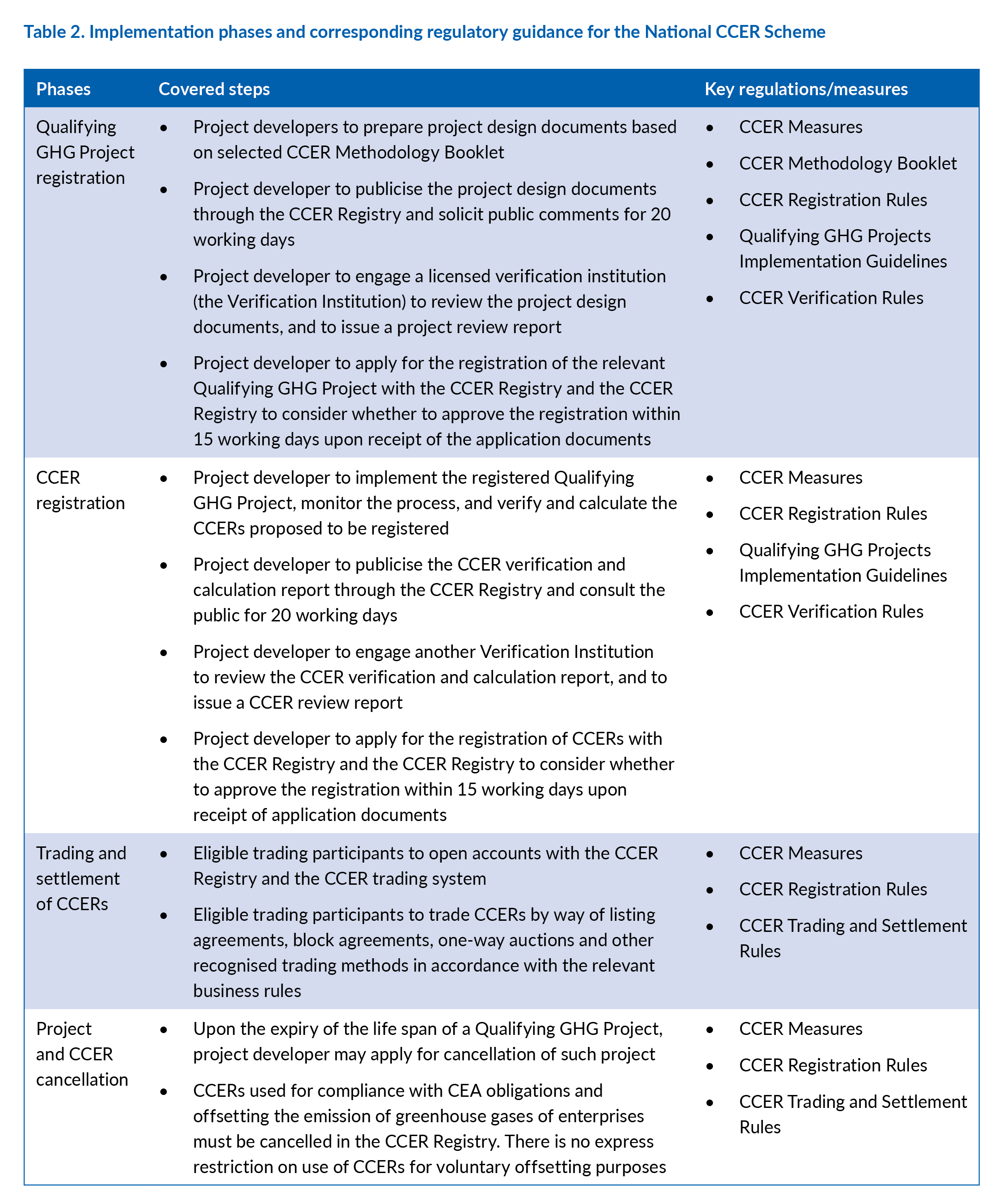

Structure of the National CCER Scheme

Since October 2023, various regulations and measures have been issued to guide the relaunch of the National CCER Scheme. Table 2 sets out the implementation phases and the corresponding regulatory guidance.

Terry Yang, Partner, Jane Chen, Senior Associate, and Kirsty Souter, Senior Associate

Clifford Chance

Copyright © April 2024 Clifford Chance

Part 2 of this article, in which the authors discuss the challenges and key considerations for international investors in relation to China’s carbon market, will be published in next month’s edition of CGj.