The Mainland releases new rules on overseas issuances and listing activities

In this second and final part of their article on the Mainland’s new Overseas Listing Regime, Benran Huang, Managing Associate, Moge Chen, Associate, and Alex Guo, Associate, Zhao Sheng Law Firm (Linklaters’ joint operation partner in the Mainland), discuss the listability of VIE structures, the impact of corporate governance changes and various disclosure requirements, transitional arrangements and the formal communication procedure with CSRC.

A clearer stance on VIE structures?

Variable interest entity (VIE) structures are widely used by China Based Enterprises who operate business that are foreign investment prohibited or restricted. The use of VIE structures has never been formally endorsed by any Mainland regulator.

In the context of initial public offerings (IPOs), there have been concerns raised in the market in recent years over whether Mainland regulators will take a drastic approach toward overseas IPOs involving VIE structures.

The Overseas Listing Regime now provides a clearer stance – the listability of VIE structures in principle is not ruled out. According to the China Securities Regulatory Commission (CSRC), ‘CSRC will seek opinions from competent regulator(s) and complete filings for overseas listings by enterprises with VIE structures in place that satisfy compliance requirements, and will support enterprises in taking advantage of both markets and resources to develop and grow.’

Regulatory Guideline No 2 provides that, where an issuer with a VIE structure files with CSRC for an overseas IPO, the following specific disclosures on the VIE structure must be included in its application report:

- reasons for the set-up of the VIE structure and the specific arrangements

- risks associated with control, counterparty default and tax issues, and

- risk mitigants.

In addition, Regulatory Guideline No 2 also requires the issuer’s Mainland counsel to verify and provide statements on:

- foreign investors’ participation in the operation and management of the issuer (for example, the appointment of directors)

- whether any Mainland law, regulation or other rule expressly prohibiting contractual control over business, permits or qualifications would be applicable to the issuer, and

- whether the VIE entity falls under national security review, or is involved in foreign investment prohibited or restricted business.

CSRC is believed to have formulated the above disclosure requirements by reference to the earlier negative list jointly issued by the National Development and Reform Commission (NDRC) and the Ministry of Commerce (MOFCOM). (See ‘NDRC and MOFCOM approach’.) Whilst as a general principle VIE structures are listable, we expect that the overseas IPOs involving VIE structures could be subject to heightened scrutiny under certain circumstances.

- Significant participation by foreign investors in operation and management. We consider that significant participation by foreign investors in the operation and management of an issuer may become a substantial hurdle to the issuer’s overseas IPO, albeit the boundary remains to be tested, including (1) whether the extent of veto rights available to foreign investors matters, (2) whether the right to appoint one or more director(s) alone by foreign investors (without the ability for foreign investors to control the board or determine or veto the appointment of senior management personnel) would cause an issue, and (3) whether corporate governance rights by foreign investors pre-IPO that would lapse upon an IPO would be acceptable to CSRC.CSRC’s view towards these issues may have an impact on how foreign investors negotiate corporate governance terms during a pre-IPO financing of an issuer with a VIE structure in place and even the investment strategy of foreign investors towards the issuer.

- Operation in a sector with express prohibition over contractual control. The overseas IPO by an issuer that operates in a sector with express prohibition over contractual control (for example, private education and online gaming) may be subject to heightened scrutiny, in particular if the prohibition is provided by an applicable law or regulation promulgated by the State Council, as compared to any rule promulgated at a lower hierarchy.

- Operation in a foreign prohibited sector as compared to a foreign restricted sector. In light of the approach taken by NDRC and MOFCOM in the negative list, it remains to be tested whether CSRC will take a similar approach and view VIE structures in a foreign prohibited sector more cautiously as compared to VIE structures in a foreign restricted sector.

The Overseas Listing Regime does not contain provisions directly affecting any already listed issuers that have VIE structures in place. We therefore expect that the Overseas Listing Regime will not have a direct impact on their listing status, but could have an impact on their subsequent overseas listing activities.

We also expect that the Hong Kong Stock Exchange, having previously issued listing decision HKEX-LD43-3 on VIE structures, will be revisiting its practice towards VIE structures in light of the Overseas Listing Regime.

Transitional arrangements

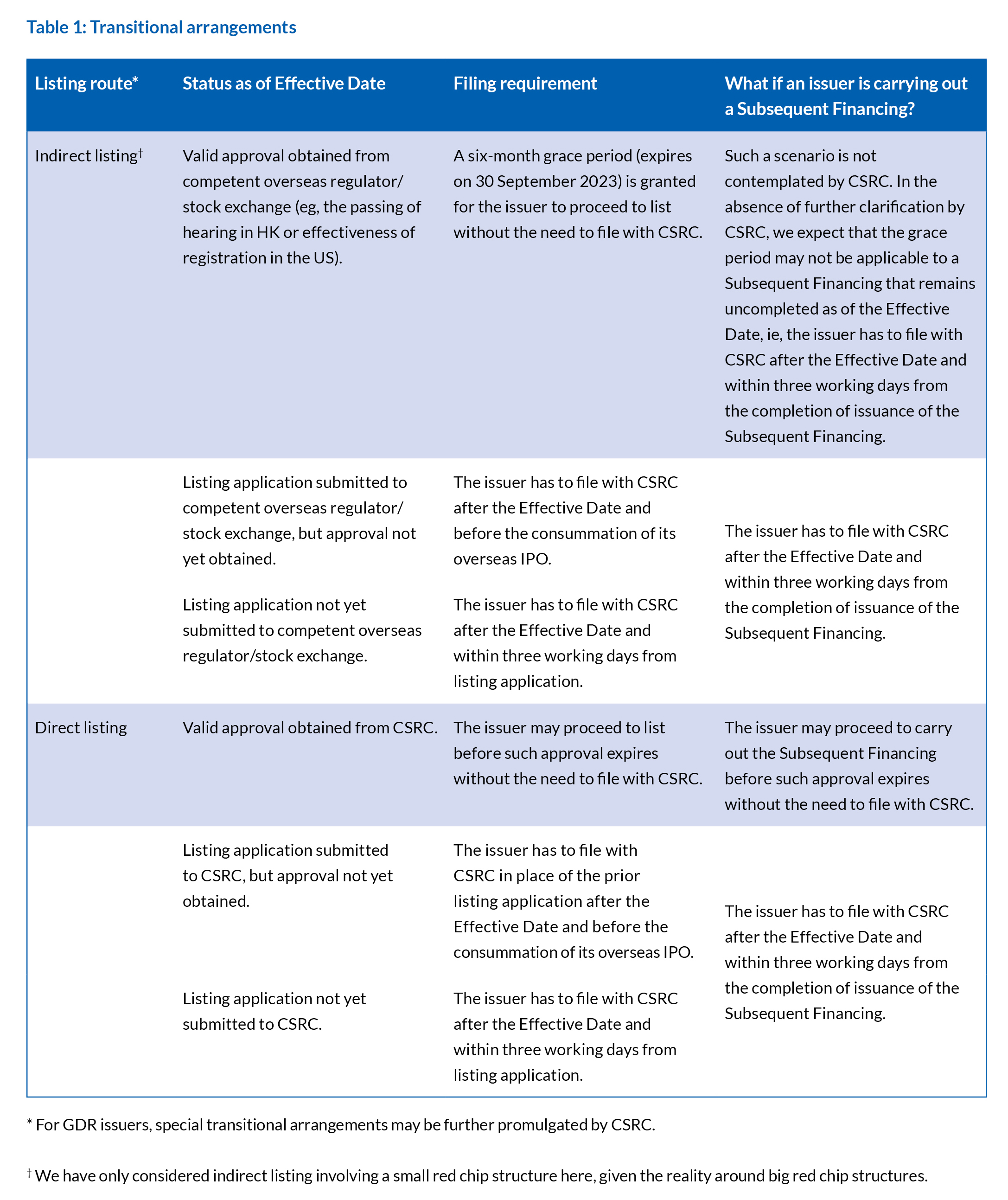

For issuers that are carrying out but have not completed their overseas IPOs before the Effective Date, Table 1 summarises the transitional arrangements that apply with respect to their proposed overseas IPOs.

Other highlights

Corporate governance changes to future H share listed companies

Mandatory Provisions abolished. The Overseas Listing Regime provides that the Mandatory Provisions for Articles of Association of Companies Listing Overseas (the Mandatory Provisions) issued in 1994 shall expire on the Effective Date. Going forward, in the case of a direct listing, the issuer shall prepare its articles of association by reference to the Guidelines on the Articles of Association of Listed Companies (2022 Revision) (the AOA Guidelines). The abolition of the Mandatory Provisions is a long-awaited step, as they are too outdated to reflect the latest and more modernised corporate governance practice in the Mainland.

However, it is worth noting that the Hong Kong Listing Rules nevertheless explicitly require that the articles of association of issuers incorporated in the Mainland must include the Mandatory Provisions. We expect that the Hong Kong Stock Exchange will revisit its Listing Rules in light of the Overseas Listing Regime, but before the two regimes are fully reconciled, listing applicants in the Hong Kong market will technically still need to include the Mandatory Provisions in their articles of association, or otherwise consult or seek exemption from the Hong Kong Stock Exchange.

- Special voting rights may become viable for H share listed companies. Regulatory Guideline No 2 provides that an issuer shall disclose any special voting rights arrangements in its application document. Such arrangements, which are not uncommon for non–Mainland incorporated enterprises, have never historically been adopted by H share listed companies.

This provision seems to imply that such arrangements may become acceptable to CSRC for H share listed companies.

Considering that the Company Law of the People’s Republic of China is also being reformed, and that the earlier draft for public consultation for the first time provides that a Mainland incorporated joint stock company can issue different classes of shares with different rights, we expect that special voting rights arrangements for H share listed companies may become possible in the near future.

Potential impact on the structuring of ESOPs

Regulatory Guideline No 2 requires an issuer’s Mainland counsel to state in its legal opinion certain detailed arrangements relating to any employee stock ownership plan (ESOP) adopted by the issuer, including the composition of grantees, fairness of pricing, the applicable decision-making procedure and the ESOP’s compliance with laws and regulations. Regulatory Guideline No 2 also specifically requires that all shares subject to an ESOP shall, in principle, be for the benefit of the issuer’s own employees and, if there is any non-employee grantee, the issuer’s Mainland counsel is required to verify the rationale and other details of such an arrangement.

Separately, Regulatory Guideline No 2 also requires an issuer’s Mainland counsel to verify and opine on any nominee shareholding arrangement involving the issuer.

These requirements may have implications for the structuring of an ESOP of a non–Mainland incorporated China Based Enterprise, as the practice with respect to ESOPs by non–Mainland incorporated China Based Enterprises is currently fairly relaxed. For pre-IPO investors of such an enterprise, extra due diligence on its ESOP arrangement from an Overseas Listing Regime compliance perspective may be worth considering.

‘Look-through’ of ultimate beneficial owners

Regulatory Guideline No 2 requires the issuer to disclose the ultimate beneficial owners of all major shareholders (that is, any shareholder holding 5% or above of the shares or voting rights), which requirement broadly mimics the look-through principle adopted by CSRC in regulating A share IPOs.

As an exception, the look-through does not apply to a foreign private equity fund if (i) it is not a holding entity or platform set up merely for the purpose of holding shares, and (ii) its investment price in the issuer is not manifestly abnormal, provided that the issuer is nevertheless required to disclose any Mainland persons behind the fund. The exception is drafted in relatively vague terms. Also, according to Regulatory Guideline No 2, the look-through will stop at sovereign wealth funds, pension plans and publicly offered asset management products, etc. To understand the look-through principle and the exception, it is worth noting that one of the primary reasons for the look-through by CSRC is to assess whether any person (in particular any Mainland governmental officer) has unlawfully benefited from the financing activities of an issuer. The above requirements on ESOPs serve a similar purpose to some extent.

Such obligation to disclose the ultimate beneficial owners is, generally speaking, more onerous than the compatible obligations imposed by regulators in Hong Kong and the US. Certain investors (for example, private equity funds) may find it difficult to provide information on their ultimate beneficial owners to the issuer, either because they are subject to contractual restrictions from disclosing the identities of their ultimate beneficial owners or they simply do not have the requested information.

In A shares IPOs, investors and issuers often face the same difficulty and challenge. In practice, issuers collect and report such information to CSRC on a ‘best effort’ basis. Material omission of the required information could have a negative impact on an issuer’s listability. We expect that market players will apply a similar approach in overseas listings.

More than just a regulation over issuers

The Overseas Listing Regime is a comprehensive regulatory regime that not only regulates China Based Enterprises as issuers, but also purports to oversee and monitor overseas listings in the market through gatekeepers, including securities companies and law firms.

The Overseas Listing Regime imposes filing and reporting obligations on securities companies and sets out detailed requirements on the contents to be included in Mainland legal opinions. In the case of any violation of the Overseas Listing Regime, penalties may be imposed on these gatekeepers and their directly responsible personnel, in addition to the issuers. (See ‘Filing and reporting obligations on securities companies’.)

Formal communication procedure with CSRC

The Overseas Listing Regime establishes a formal procedure for issuers to communicate with CSRC to seek clarification on the regime, and such communication may be (and is not required to be) made either prior to or during a filing:

- prior to a filing, an issuer can seek clarification from CSRC on matters such as sector regulation policy, capital structure and whether the filing requirement is applicable to the issuer, and

- during a filing, an issuer can seek clarification from CSRC on matters such as CSRC’s supplemental document requests and new matters or changes emerging during the filing process that may affect the overseas listing.

The Overseas Listing Regime also permits different methods of communication, including written communication, telephone, videoconference or face-to-face meeting.

Issuers can (and other stakeholders can via issuers) make use of this communication mechanism to guide their financing activities both before and during their overseas IPOs. However, the Overseas Listing Regime expressly provides that CSRC’s responses given during any such communication shall not be used as a basis for assessing whether a proposed overseas listing is in compliance with applicable laws. An issuer should exercise special caution before sharing the results of any such communication with any overseas regulator or stock exchange to facilitate its proposed overseas listing.

Benran Huang, Managing Associate, Moge Chen, Associate, and Alex Guo, Associate

Zhao Sheng Law Firm (a member of the Linklaters global network) © Copyright Zhao Sheng Law Firm, February 2023

SIDEBAR: NDRC and MOFCOM approach

On 27 December 2021, NDRC and MOFCOM jointly issued a substantially shortened negative list applicable to foreign investment in the Mainland. The negative list provides that a China Based Enterprise that operates in a foreign investment prohibited sector may conduct an overseas listing provided that (1) the listing is approved by competent sector regulator(s), (2) foreign investors do not participate in its operation and management, and (3) the shareholding percentage limits on foreign investors (that is, 10% individually and 30% in the aggregate) are not crossed.

There was discussion in the market whether this means that overseas IPOs involving VIE structures in foreign investment prohibited sectors must, amongst others, always obtain prior approval from competent sector regulator(s), with the concern that if so, there would be a much higher risk of such overseas IPOs becoming unfeasible. Although a spokesman of NDRC subsequently clarified that these requirements are only applicable to direct listing activities, and that CSRC would separately determine the approach towards indirect listing activities, there was still speculation in the market that CSRC might take a similar approach towards indirect listing activities.

SIDEBAR: Filing and reporting obligations on securities companies

If a foreign securities company engages in an overseas listing as a sponsor or lead underwriter, it shall file with CSRC within 10 working days from the date of signing of the initial business agreement and shall submit to the CSRC a report describing last year’s business operations related to overseas listing before 31 January of each year.

A foreign securities company that has already entered into a business agreement prior to the Effective Date, and is acting as a sponsor or lead underwriter for an overseas listing, shall file with CSRC within 30 working days from the Effective Date.