Perception-reality gap on the benefits brought by female directors in Hong Kong

Authors from the School of Business, The Hang Seng University of Hong Kong, discuss the results of their recent survey on perceptions of board gender diversity in Hong Kong listed companies.

Highlights

- HKEX now mandates the end of single-gender boards for listed companies after 31 December 2024, but it is unclear whether this will necessarily improve the powerbase of female directors

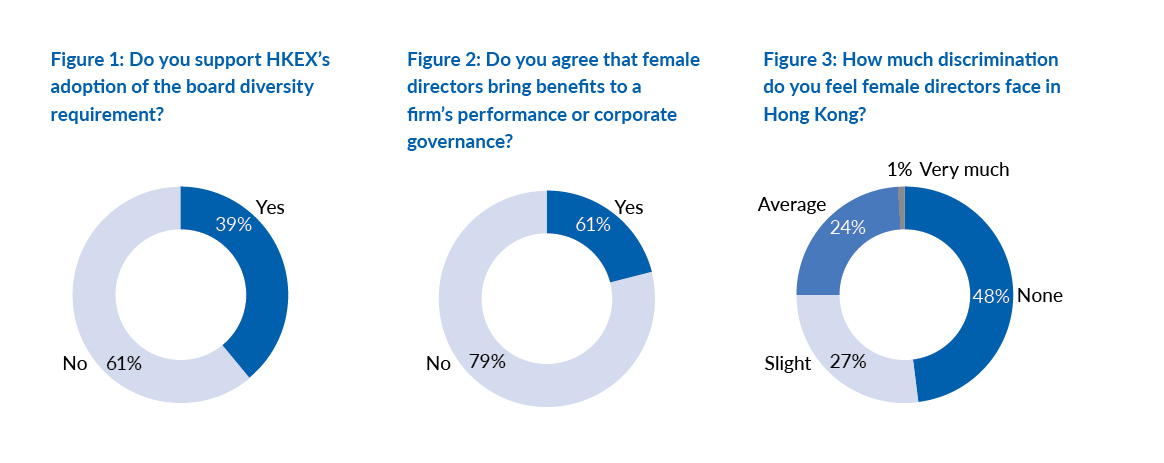

- a survey of listed companies undertaken by The Hang Seng University of Hong Kong reveals that 61% do not support a mandatory board diversity requirement, while 79% do not agree that female directors benefit the board

- survey findings show a perception-reality gap in Hong Kong regarding the contribution made by female directors, with traditional cultural influences still downplaying the leadership capabilities of women

Board gender diversity has been a significant global trend, stimulated by various jurisdictions’ guidelines and/or laws aimed at increasing the presence of women on the boards of listed companies. Some regulators have adopted the ‘comply or explain’ governance mechanism (for example, the US, the UK and Australia). The comply or explain system requires firms either to satisfy board gender diversity requirements, or to explain the reasons for any failure to comply with those requirements. Meanwhile, some countries or regions have enacted legislation requiring a set quota of female representation on the board (for example, France, Spain, Italy, the UAE and India).

Board gender diversity in Hong Kong

The Hong Kong Stock Exchange (HKEX)’s revised Listing Rule 13.92 mandates the end of single-gender boards after 31 December 2024. Nevertheless, this Listing Rule, which came into effect on 1 January 2022, may not necessarily improve the powerbase of female directors. After all, gender stereotypes or gender-based discrimination is usually rooted in cultural norms. In this study, we investigate whether the perception of female directorship in Hong Kong aligns with the actual performance of listed companies that include female directors on the board.

The advancement of women in Hong Kong is evident through employment and educational opportunities. However, more traditional influences remain strong in a large sector of the population. These ingrained perspectives include a greater acceptance of subordinate social roles for women and lower expectations for female leadership representation. Even as family duties shift with the rise in the number of domestic helpers, statistics show Hong Kong continues to lag behind its Western counterparts when it comes to women in senior management and board positions. The joint effect of these factors likely contributes to ongoing discrepancies between perception and reality. Outdated perceptions that women should not, or cannot, be leaders fail to align with the proven capabilities of female directors and executives. The extent of the contribution and benefits that female directors bring to a company’s performance and corporate governance may not be well recognised.

outdated perceptions that women should not, or cannot, be leaders fail to align with the proven capabilities of female directors and executives

The benefits of board gender diversity

Research indicates that one of the primary benefits of board gender diversity is that the inclusion of female directors enhances monitoring by the board. Studies have shown that female directors are more responsible, accountable and careful compared with their male counterparts (Fondas and Sassalos, 2000; Schmitt, Realo, Voracek and Allik, 2008). Women tend to take their roles seriously in the boardroom, which can lead to improved corporate governance (Singh and Vinnicombe, 2004; Usman, Zhang, Wang, Sun and Makki, 2018; Ain, Yuan, Javaid, Usman and Haris, 2021). In addition, female directors communicate more effectively with external entities (Kravitz, 2003; Huse and Solberg, 2006). As gender equality becomes more mainstream in society, companies are under increased pressure to conform to social values and to respond with a more gender-diverse board. Female participation on the board can thus promote women’s rights and strengthen the firm’s legitimacy in society (Cox and Blake, 1991; Cox, Lobel and McLeod, 1991).

Survey of Hong Kong listed companies

To understand the perception of female directorship among Hong Kong listed firms, we conducted a survey in July and August 2021. We contacted the investor relations departments of all listed companies by telephone, or via an email questionnaire. We did not record the name or sex of the respondents, but we reminded them that their responses would be representing the firm. However, we acknowledged that some of our survey results would be subjective, based on the respondents’ personal perceptions. Out of a population of 2,568 listed firms in Hong Kong as of July 2021, we received 95 valid responses. Our sample size represents approximately 95% confidence level with a 10% margin of error.

The survey, comprising seven questions in total, was divided into three sections to understand: (1) the respondents’ support for the board diversity rule adopted by HKEX (three questions in total), (2) their agreement with the benefits brought by female directors (two questions), and (3) their opinion on the discrimination faced by female directors in Hong Kong (one question). The survey questions, discussed below, were short, specific and simply written to avoid ambiguity or vagueness.

Support for the board diversity rule

Our first survey question asked the respondents whether they supported HKEX’s adoption of the board diversity requirement. Specifically, we defined the board diversity requirement as a modified Rule 5605(f) of the Nasdaq Listing Rules, namely that all listed companies in Hong Kong are required to have at least two diverse directors, including one female director and one non-Chinese director, or to explain why the board does not include such diverse directors. 61% of respondents were against such a proposal (see Figure 1). They explained that it is difficult to appoint a diverse director (41% of those who did not support the idea) and that appointing a diverse director cannot improve board efficiency (45%).

We then asked the respondents whether they supported HKEX’s requirement for mandatory disclosure of board-level diversity statistics. 78% of respondents supported this idea. Of those who were against the proposal, 81% supported voluntary disclosure on the basis that it would provide more flexibility to a firm to disclose information suitable for investors.

Agreement with the benefits brought by female directors

Next, we asked the respondents whether their company has any female directors at the moment. 66% of respondents replied positively, which is consistent with our empirical findings (see below). When we further asked the respondents whether they agree that female directors bring benefits to a firm’s performance or corporate governance, 79% of respondents disagreed (see Figure 2). For those who recognised female directors’ contribution to the company, they suggested that female directors have more professional knowledge and expertise (60%), can improve the firm’s reputation (65%), can improve employee satisfaction (55%) and can improve the firm’s stock price (45%).

We then asked the respondents to propose some ways to increase board diversity. Common suggestions included appointing directors with different professional backgrounds (93%), different age groups (84%), different ethnic or cultural backgrounds (67%) and overseas education or working backgrounds (61%).

Opinions on the discrimination faced by female directors

Finally, we asked the respondents how much discrimination they felt female directors face in Hong Kong. Most of the respondents considered that female directors face ‘none’ (48%) or ‘slight’ (27%) discrimination. 24% of respondents felt that female directors face ‘average’ discrimination and only 1% of respondents expressed the opinion that female directors face ‘very much’ discrimination (see Figure 3).

Empirical evidence of the benefits brought by female directors

To empirically test whether female directorship is positively associated with both financial reporting quality and firm performance, we constructed a sample comprising all Hong Kong listed companies between 2001 and 2019. 65% of our archival sample firms had at least one female director, which is consistent with our survey results (66%). On average, the percentage of female directors on boards was 12%. 29% of our archival sample firms had a dual CEO/Chairman role, suggesting centralised and concentrated power in a few key individuals in the company. The ratio of independent non-executive directors on the board was 40%.

Our main empirical test results show that female directors are more likely to constrain the practice of earnings management. Moreover, firms with a higher ratio of female directors tend to have a higher return on assets and return on sales. This evidence supports prior research demonstrating that female participation in the boardroom is beneficial to financial reporting quality and financial performance. Our further empirical test results reveal that benefits brought by female directors primarily come through the female executive directors’ executive effect, rather than the female independent directors’ monitoring effect. Meanwhile, our analysis shows that the special state-dominant ownership structure in state-owned enterprises (SOEs) hampers the ability of female directors to fulfil their duties successfully, as female directorship is not significantly associated with financial reporting quality or financial performance in SOEs, but the association does remain significant in non-SOEs.

Discussion

Our findings reveal an interesting perception-reality gap in Hong Kong regarding female directors. While empirical evidence demonstrates that including women on boards enhances financial reporting and performance, survey responses show disagreement and scepticism about these benefits. In addition, over 60% opposed the mandated board diversity requirements. This disconnect highlights the complex cultural dynamics at play in Hong Kong. Progressive values championing female empowerment now intersect with traditional perspectives prescribing gender roles and biases. Although women have advanced, cultural norms still appear to downplay their leadership capabilities.

Outdated biases persist, obstructing the recognition of the value that diversity brings. Stereotypes and tokenism may further hinder women from maximising their governance impact.

The evidence in this study indicates that female representation on the board is desirable, but that cultural factors cannot be neglected. It remains to be seen whether the end of single-gender boards after 31 December 2024 will simply become a practice of tokenism.

Assistant Professors Hong Weng Lawrence Lei, Yam Wing Siu, Ling Na Belinda Yau and Weiyin Vivian Zhang

School of Business, The Hang Seng University of Hong Kong

The authors can be contacted at: lawrencelei@hsu.edu.hk, ywsiu@hsu.edu.hk, belindayau@hsu.edu.hk and vivianzhang@hsu.edu.hk.